Managing finances is crucial for any business. You need efficient tools for this task.

Finding the best accounting software can be overwhelming. You want something powerful, yet easy to use. Ease of use is vital for busy professionals. Complex software can slow you down. User-friendly accounting software allows you to focus on your business.

You can manage invoices, track expenses, and generate reports with ease. No need for extensive training or technical skills. Whether you’re a small business owner, freelancer, or managing a larger company, the right software can save you time and stress. This blog will help you find the perfect fit, making your financial tasks simple and hassle-free. Dive in to explore the best options for your needs.

Introduction To User-friendly Accounting Software

Accounting can be complicated. But with the right software, managing finances becomes easier. User-friendly accounting software is designed to simplify tasks. It helps businesses and individuals maintain accurate financial records without stress.

Importance Of Simplicity

Simplicity in accounting software is crucial. It reduces the learning curve. Users can quickly understand the interface. This saves time and increases productivity. Simplicity ensures fewer errors. Accurate data entry is vital for financial health. Easy-to-use software also means less need for technical support. Users feel more confident and in control of their finances.

Benefits Of Streamlined Finances

Streamlined finances offer several benefits. First, they improve efficiency. Tasks that took hours can be done in minutes. This frees up time for other important activities. Second, streamlined finances provide better insights. Users can generate reports easily. This helps in making informed decisions. Third, it ensures compliance. Accurate records meet regulatory requirements. This avoids penalties and legal issues.

Overall, user-friendly accounting software is a valuable tool. It simplifies tasks, reduces errors, and saves time. It also provides better financial insights and ensures compliance.

Credit: financfy.com

Top Features Of Easy-to-use Accounting Software

Choosing the best accounting software involves considering its ease of use. Easy-to-use accounting software should make financial management a breeze. Here are some top features to look out for:

Intuitive Interface

An intuitive interface is crucial. It helps users navigate the software without confusion. The interface should be clean and straightforward. Users should find menus, buttons, and options easily.

- Simple Dashboard: Displays key financial data at a glance.

- Clear Navigation: Users can access different sections easily.

- Responsive Design: Works well on both desktop and mobile devices.

Automated Functions

Automated functions save time and reduce errors. They handle repetitive tasks efficiently. This frees up time for more important activities.

Key automated functions include:

- Invoice Generation: Automatically creates and sends invoices.

- Expense Tracking: Tracks and categorizes expenses.

- Bank Reconciliation: Matches transactions with bank statements.

| Feature | Description |

|---|---|

| Reminder Notifications | Sends alerts for upcoming payments and deadlines. |

| Data Backup | Automatically backs up data to prevent loss. |

These features ensure that accounting tasks are handled smoothly and accurately. Choose software that offers these to make accounting less stressful.

Popular Accounting Software Options

Choosing the right accounting software can streamline your business operations. Popular options offer various features tailored to different needs. Here are two standout choices:

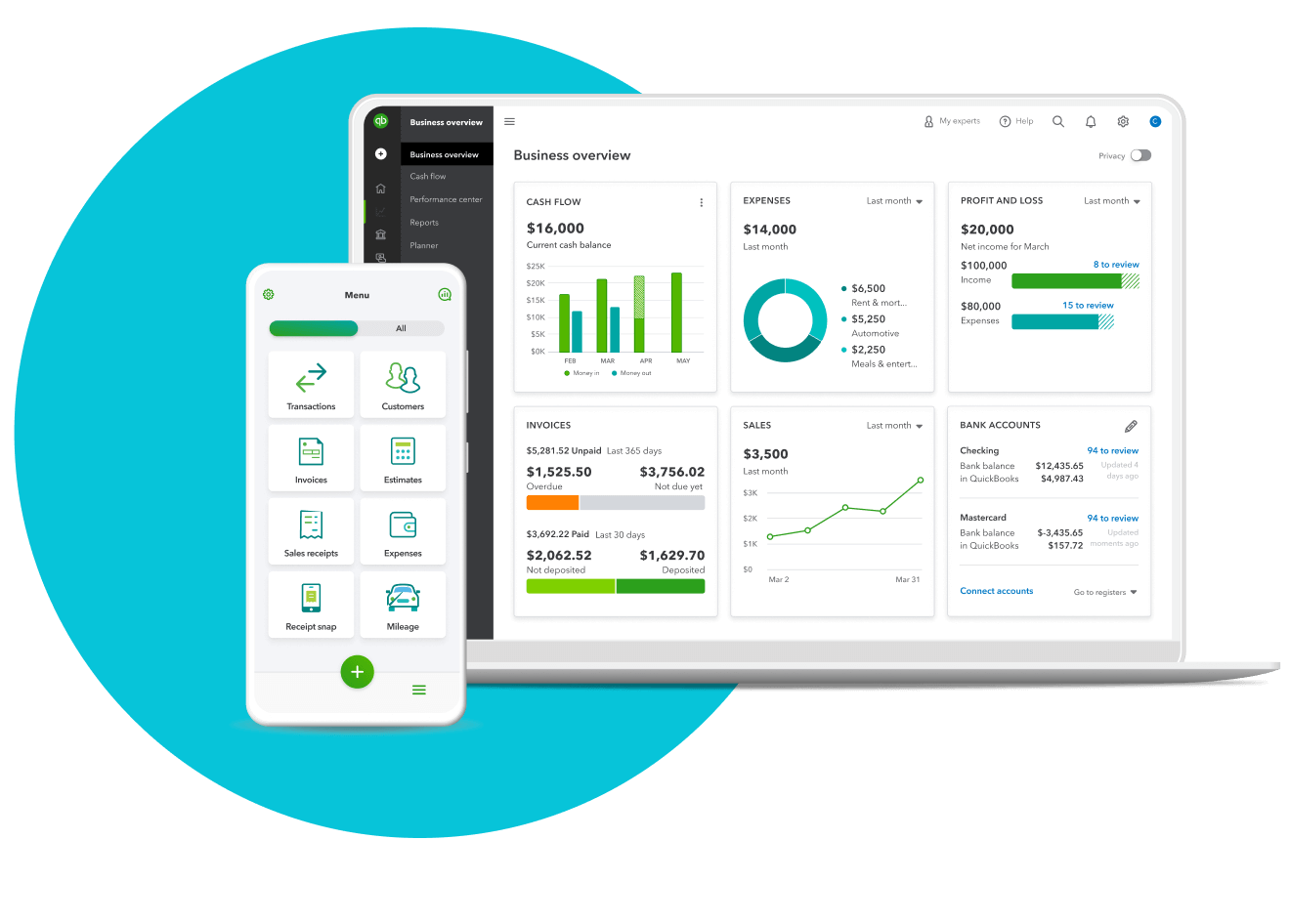

Quickbooks

QuickBooks is a widely used accounting software. It suits small to medium-sized businesses. The user-friendly interface makes bookkeeping tasks simple. You can easily track income and expenses.

Key features of QuickBooks include:

- Invoicing

- Expense tracking

- Financial reporting

- Payroll management

QuickBooks offers multiple plans. Choose one that fits your business size and needs. It also integrates with many third-party apps. This enhances its functionality further.

Freshbooks

FreshBooks is another great option. It is ideal for freelancers and small business owners. The interface is very intuitive. Users can manage invoices and track time easily.

Important features of FreshBooks include:

- Professional invoicing

- Expense tracking

- Project management

- Time tracking

FreshBooks provides excellent customer support. This ensures users can get help when needed. It also offers integrations with various tools. This makes managing your business even easier.

Choosing The Right Software For Your Business

Choosing the right accounting software for your business can seem like a big task. But with the right approach, you can find software that fits your needs and budget. Let’s break down the process to make it easier.

Assessing Your Needs

First, identify what you need from your accounting software. Do you need basic bookkeeping or advanced features like payroll and tax filing?

Create a list of must-have features:

- Invoicing

- Expense tracking

- Financial reporting

- Inventory management

- Payroll processing

Think about your industry. Some software offers specialized tools for retail, manufacturing, or services. Consider your team. If you have multiple users, look for software with user permissions and collaboration features.

Budget Considerations

Next, set a budget. Accounting software comes in various price ranges. Free options offer basic features. Paid plans provide more advanced tools.

Compare the costs of popular options:

| Software | Basic Plan | Advanced Plan |

|---|---|---|

| QuickBooks | $25/month | $70/month |

| FreshBooks | $15/month | $50/month |

| Wave | Free | Custom pricing |

Remember, the cheapest option isn’t always the best. Look at the value each software provides. Consider trial periods. Many software vendors offer a free trial. Test the software before committing to a plan.

By assessing your needs and considering your budget, you can choose the right software for your business. It will make your accounting tasks easier and more efficient.

Integrating Accounting Software With Other Tools

Integrating accounting software with other tools simplifies the management of business processes. Seamless integration boosts efficiency and reduces manual data entry. Here, we will explore integrating accounting software with CRM systems and payment gateways.

Crm Systems

Customer Relationship Management (CRM) systems track interactions and manage customer data. Linking accounting software with CRM systems provides a unified view of customer information. This integration helps businesses track sales, invoices, and payments in one place. It also ensures accurate financial records. With integrated systems, customer data updates automatically across platforms. This saves time and reduces errors.

Payment Gateways

Payment gateways process online transactions securely. Integrating accounting software with payment gateways streamlines the payment process. It automates recording transactions, reduces manual entry, and ensures accuracy. Businesses can track payments and manage cash flow better. Integration also improves the customer experience. Payments are processed quickly and securely. This builds trust and enhances customer satisfaction.

Credit: bestaccountingsoftware.com

Security And Compliance Features

When choosing the best accounting software, security and compliance are critical features. Protecting financial data is essential. Ensuring the software meets regulations is equally important. Let’s explore some key aspects.

Data Encryption

Data encryption ensures your financial data stays private. It converts data into code. Only authorized users can read it. This protects against cyber threats. Encrypted data is harder to hack. Strong encryption standards are vital. Look for software using AES-256 encryption. This level is highly secure. It’s used by banks and governments.

Regulatory Compliance

Compliance with regulations is a must. Accounting software should follow laws like GDPR or HIPAA. These laws protect customer data. Non-compliance can lead to fines. Look for software with built-in compliance features. This ensures you meet legal requirements. It reduces the risk of penalties. Staying compliant builds trust with clients.

Tips For Transitioning To New Accounting Software

Switching to new accounting software can seem difficult. But with the right steps, it can be smooth and stress-free. Here are some tips to help you transition successfully.

Training Your Team

Training your team is essential. First, identify key users who need in-depth training. These users will help others. Next, use the software’s training resources. Many providers offer tutorials and webinars. These resources are helpful and often free.

Consider hands-on training sessions. Allow team members to practice with the software. This way, they can learn by doing. Encourage questions during training. This helps clear doubts and ensures everyone understands the software.

Finally, create a support system. Assign go-to persons for software-related queries. This ensures quick help and boosts confidence in using the new software.

Migrating Data

Migrating data is a critical step. Start by backing up your current data. This prevents data loss during the transition. Next, clean your data. Remove duplicates and outdated information. Clean data ensures a smooth migration.

Many accounting software providers offer migration tools. Use these tools for a seamless transfer. They often come with step-by-step instructions. If needed, seek professional help. Some providers offer migration services. This can save time and reduce errors.

After migration, verify the data. Check for any missing or incorrect entries. Correct any issues immediately. This ensures accuracy and reliability of your new system.

Credit: www.pcmag.com

Maximizing The Benefits Of Your Accounting Software

Maximizing the benefits of your accounting software involves more than just using its basic features. By ensuring regular updates and leveraging customer support, you can enhance its effectiveness. This will lead to better financial management.

Regular Updates

Regular updates are crucial for your accounting software’s performance. Updates often include bug fixes, new features, and security enhancements. Keeping your software updated ensures you have the latest tools and protections.

Consider the following benefits of regular updates:

- Improved Security: Updates protect against new threats.

- Enhanced Features: New tools and improvements are added.

- Bug Fixes: Issues are resolved for smoother operation.

Customer Support

Good customer support can make a significant difference in your experience with accounting software. Whether you have a technical issue or need help with a feature, reliable support is invaluable.

Here’s how customer support benefits you:

- Quick Issue Resolution: Get help with problems promptly.

- Expert Guidance: Support teams offer advice on best practices.

- Training Resources: Access tutorials and documentation.

By taking advantage of regular updates and customer support, you can maximize the benefits of your accounting software. This leads to more efficient and effective financial management.

Frequently Asked Questions

What Is The Easiest Accounting Software To Use?

The easiest accounting software to use is typically user-friendly and has intuitive interfaces. Popular choices include QuickBooks, FreshBooks, and Xero. These platforms offer straightforward navigation, making accounting tasks simple for beginners and experienced users alike.

Can Beginners Use Accounting Software?

Yes, beginners can use accounting software. Most modern accounting software is designed with user-friendly interfaces. They provide tutorials and customer support to help users get started. These features make it easy for beginners to manage their accounting tasks efficiently.

Which Accounting Software Is Best For Small Businesses?

QuickBooks is often considered the best for small businesses. It offers a range of features tailored to small business needs. Other good options include FreshBooks and Wave, which provide easy-to-use tools for managing finances, invoicing, and expenses.

Is Cloud-based Accounting Software Secure?

Yes, cloud-based accounting software is generally secure. Providers implement high-level encryption and security measures to protect your data. Regular updates and backups ensure your financial information is safe from breaches and data loss.

Conclusion

Choosing the right accounting software can simplify your business tasks. Easy-to-use options save time and reduce stress. These tools manage your finances efficiently. They offer user-friendly features for non-experts. Small businesses benefit from streamlined accounting. You can focus on growth rather than bookkeeping.

Explore different software to find what fits best. Remember, the right tool makes all the difference. Start with a free trial to ensure it meets your needs. Happy accounting!