Managing expenses can be challenging for businesses. The right software helps keep everything in check.

Expense management software simplifies tracking, reporting, and controlling expenses. In the UK, businesses look for solutions that are efficient and user-friendly. Finding the best software can save time and reduce errors. It can also ensure compliance with financial regulations. This blog post explores top expense management software options in the UK.

Each offers unique features to meet different business needs. Whether you run a small startup or a large enterprise, the right tool can make a big difference. Stay tuned to discover the best choices available and how they can benefit your business.

Introduction To Expense Management Software

Managing expenses can be a daunting task for businesses of all sizes. Expense management software helps simplify the process. It tracks spending, ensures compliance, and provides detailed reports. Choosing the right software can save time and reduce errors. In the UK, many options are available, each with unique features. This guide will help you understand the importance and benefits of these tools.

Importance Of Expense Management

Effective expense management is crucial for business health. It helps keep track of costs and ensures transparency. This process prevents overspending and detects fraud. It also aids in budgeting and financial planning.

| Key Aspects | Description |

|---|---|

| Cost Control | Helps monitor and reduce unnecessary expenses. |

| Transparency | Provides clear insights into where money is spent. |

| Compliance | Ensures adherence to company policies and regulations. |

| Efficiency | Simplifies the process of managing expenses. |

Benefits Of Using Software

Using expense management software offers many advantages. Here are some of the key benefits:

- Automation: Reduces manual data entry and errors.

- Time-saving: Speeds up the expense approval process.

- Real-time tracking: Provides instant access to expense data.

- Integration: Works seamlessly with other financial systems.

- Customizable Reports: Generates detailed and tailored reports.

These benefits help businesses streamline their operations. They make financial management more efficient and accurate. Choosing the best software depends on your specific needs and budget.

Top Features To Look For

Managing expenses can be challenging for businesses of all sizes. The right expense management software can simplify this task. But how do you choose the best one? Here are some top features to look for in the best expense management software in the UK.

Automated Expense Tracking

Automated expense tracking is a must-have feature. It saves time and reduces errors. This feature ensures all expenses are recorded correctly. It can track every transaction. Users do not need to enter data manually. This leads to more accurate financial records.

Receipt Scanning

Receipt scanning makes expense tracking easier. Users can scan their receipts with a smartphone. The software reads and stores the information. No need to keep paper receipts. This feature keeps all receipts organized and accessible. It is also helpful during audits.

Real-time Reporting

Real-time reporting gives instant access to financial data. This feature helps in making informed decisions. Users can see up-to-date expense reports. It shows where the money is going. Real-time reporting also helps in budget planning. It helps identify areas where costs can be cut.

Popular Expense Management Software In The Uk

Managing expenses is crucial for businesses. The right software can simplify this task. In the UK, several popular options exist. Each offers unique features to suit different needs. Here are some top choices:

Xero

Xero is a favorite among UK businesses. It offers powerful accounting features. Its expense management tools are user-friendly. With Xero, you can track spending easily. It also integrates with many banks. This ensures real-time updates on transactions.

Expensify

Expensify is known for its simplicity. It helps automate expense tracking. Users can scan receipts with their phones. Expensify then categorizes these expenses. This saves time and reduces errors. It also integrates with many accounting systems. This makes it a versatile choice.

Quickbooks

QuickBooks is a well-known name. Its expense management tools are robust. Users can link bank accounts and credit cards. QuickBooks then imports transactions automatically. This helps keep track of every penny. It also offers detailed reports. These can help businesses make informed decisions.

Comparing Leading Software Options

Comparing leading expense management software options in the UK can be challenging. Various options offer unique features tailored to different business needs. To help you make an informed decision, this section will compare the user interface, pricing plans, and customer support of top software options.

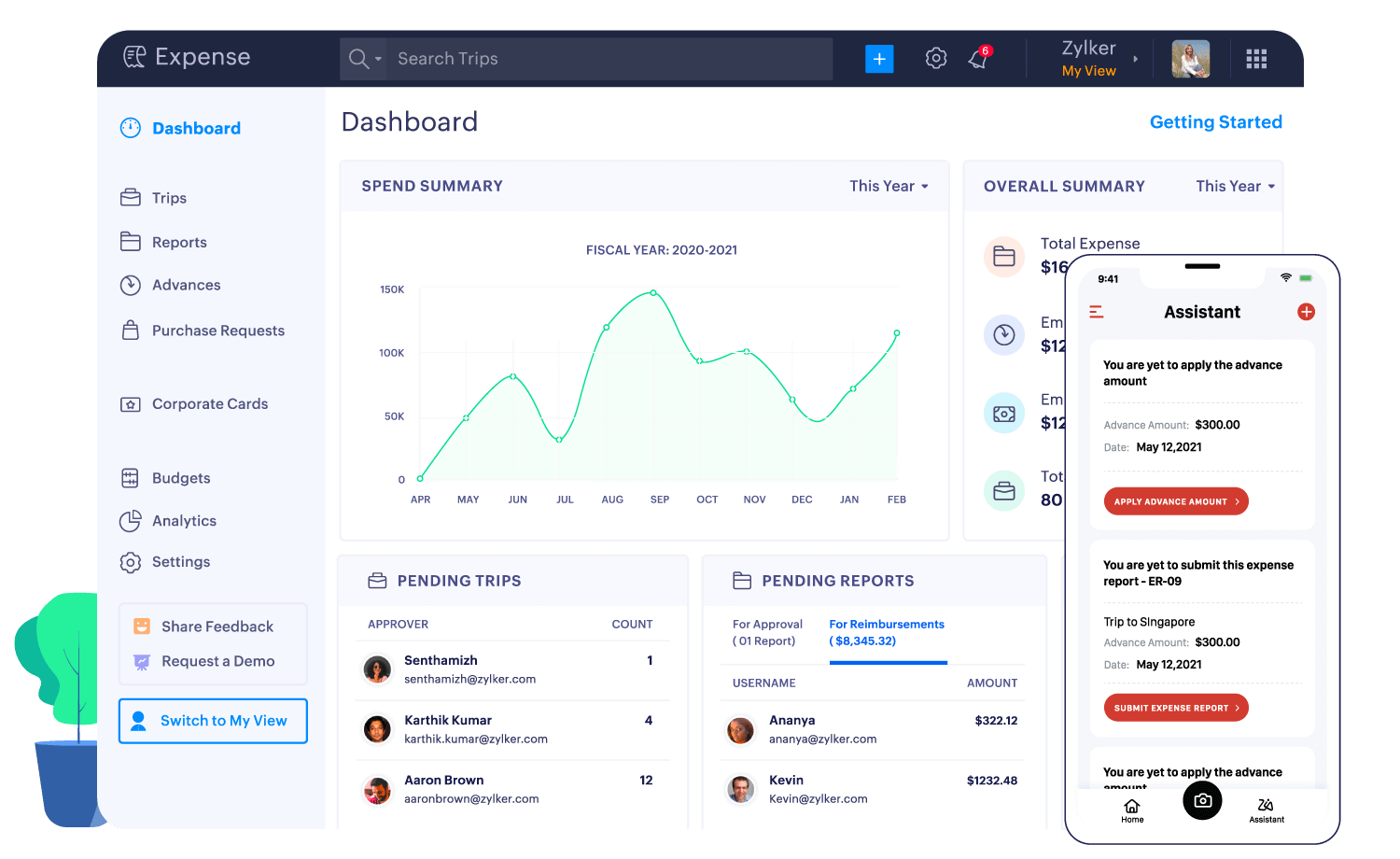

User Interface

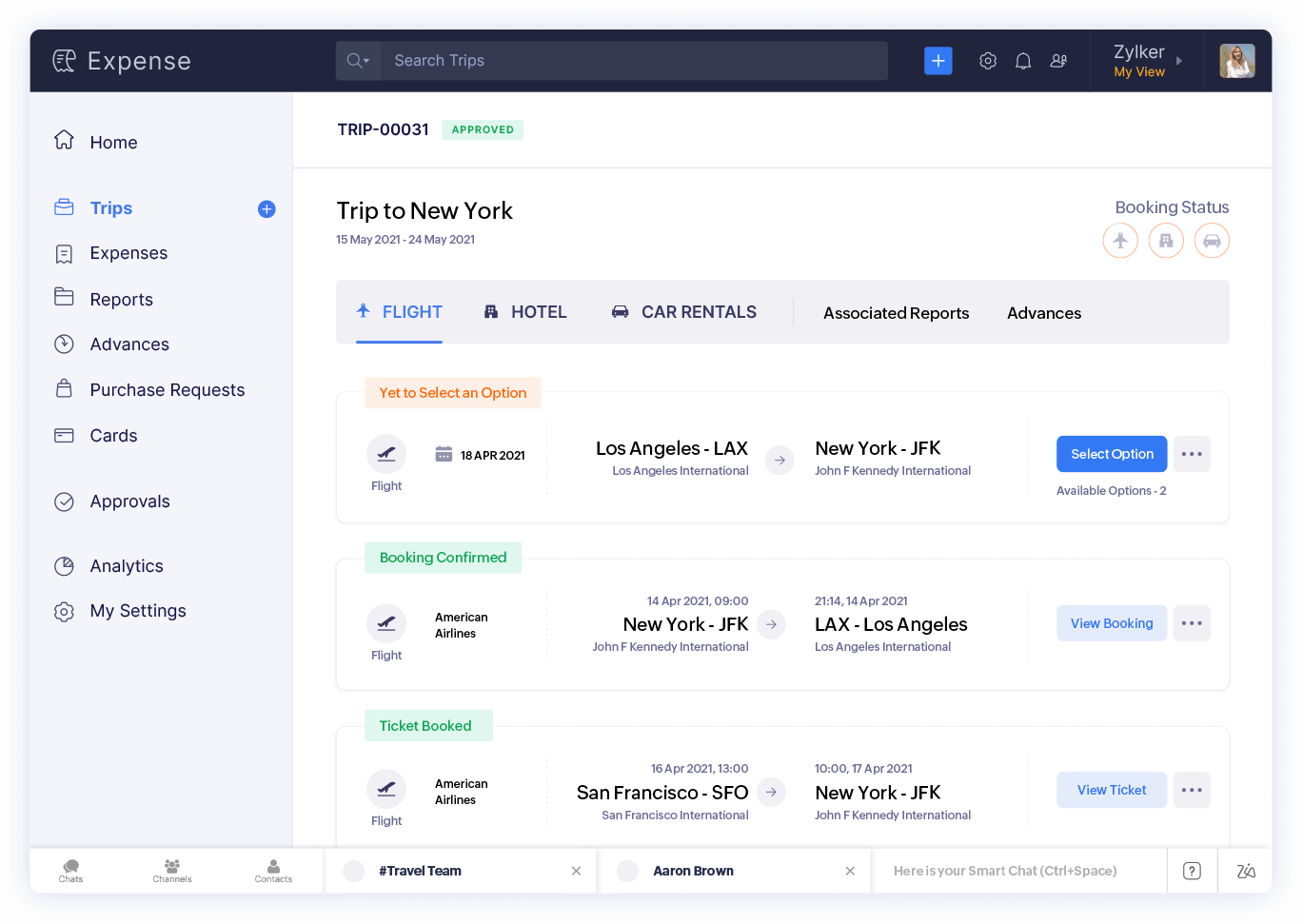

An intuitive user interface is essential for any expense management software. A clean layout with easy navigation helps users save time. Most leading software options offer dashboards with visual summaries of expenses. Look for software that provides customizable reports and integrates seamlessly with other tools. User-friendly interfaces reduce the learning curve and improve overall efficiency.

Pricing Plans

Pricing plans vary widely among expense management software. Some offer tiered pricing based on the number of users. Others might offer flat rates with added features at higher tiers. It’s important to consider your budget and the size of your team. Ensure the software provides value for money. Look for free trials or demos to test the software before committing.

Customer Support

Reliable customer support is crucial when dealing with software issues. Top software options provide multiple support channels, including email, phone, and live chat. Some also offer extensive knowledge bases and community forums. Consider the availability of support, especially if you have a global team. Quick and helpful responses can make a significant difference in your experience.

Implementation Tips

Implementing the best expense management software in the UK can seem daunting. But with the right approach, you can ensure a smooth transition. Here are some key tips to help you get started.

Assessing Your Needs

First, identify your business needs. Determine what features are essential. Consider the size of your team. Think about your current expense processes. This will help you choose the right software.

Next, set a budget. Knowing how much you can spend is crucial. Compare different software options within your budget. Look for features that provide the best value.

Integration With Existing Systems

Check if the software integrates with your current systems. This can include accounting software, payroll systems, and other tools. Seamless integration saves time and reduces errors.

Ask your software provider about integration capabilities. Look for reviews from other users. This will give you insights into how well the integration works.

Training Your Team

Your team needs to understand the new software. Arrange training sessions. Ensure everyone knows how to use the key features.

Create easy-to-follow guides. These can help your team remember important steps. Encourage questions during training. This ensures everyone is on the same page.

With these tips, implementing your new expense management software can be a breeze. Start with a clear plan. Engage your team. Make sure the software fits your needs. You’ll soon see the benefits in your business.

Credit: www.zoho.com

Maximizing Software Efficiency

Choosing the best expense management software in the UK is a great start. But how do you make the most of it? Maximizing software efficiency is key. This involves customizing features, regularly reviewing expenses, and using analytics effectively. Let’s dive into these aspects.

Customizing Features

Customizing features allows you to tailor the software to your needs. Every business is unique. So, you need software that fits your specific requirements.

- Set up categories that match your expense types.

- Create custom reports to track spending.

- Use automated alerts for unusual expenses.

These customizations help you stay organized and save time. The more you tailor the software, the more efficient it becomes.

Regularly Reviewing Expenses

Regularly reviewing expenses is vital. It helps you spot trends and address issues early. Set a schedule to review your expenses. Weekly or monthly checks work well for most businesses.

- Check for duplicate entries.

- Identify unusual spending patterns.

- Ensure all expenses are categorized correctly.

Regular reviews keep your finances in check. They also help you make informed decisions.

Using Analytics

Using analytics transforms raw data into insights. Good expense management software offers powerful analytics tools.

| Feature | Benefit |

|---|---|

| Expense Trends | See where your money goes over time. |

| Category Analysis | Understand spending by category. |

| Predictive Analytics | Forecast future expenses based on past data. |

These tools help you plan better and control costs. Leverage analytics to make smarter business decisions.

Common Challenges And Solutions

Choosing the best expense management software in the UK can be tricky. There are common challenges that businesses face. Understanding these can help you find the right solution.

Data Security Concerns

Data security is a big issue with expense management software. Businesses need to protect their financial data. Here are some key points:

- Encryption: Ensure the software uses strong encryption methods. This keeps your data safe from hackers.

- Access Controls: Limit who can access sensitive data. Only authorized personnel should have access.

- Regular Audits: Conduct regular security audits. This helps identify and fix vulnerabilities.

User Adoption Issues

Getting employees to use new software can be hard. User adoption issues can slow down the process. Consider these solutions:

- Training Programs: Offer comprehensive training for all users. This helps them understand how to use the software.

- User-Friendly Interface: Choose software with an easy-to-use interface. This makes it simpler for employees to adopt it.

- Support Services: Provide ongoing support. This ensures that users can get help when they need it.

Technical Problems

Technical problems can disrupt business operations. It’s important to address these quickly. Here are some common technical issues and their solutions:

| Problem | Solution |

|---|---|

| System Downtime | Choose software with high uptime guarantees. Ensure there is a reliable backup system. |

| Integration Issues | Select software that integrates well with your existing systems. Check compatibility before purchasing. |

| Slow Performance | Opt for software with high performance ratings. Ensure your hardware meets the software requirements. |

Credit: www.dejongphillips.co.uk

Future Trends In Expense Management

Expense management software in the UK is evolving rapidly. Companies are seeking new ways to streamline processes and improve efficiency. Understanding future trends in this field can help businesses stay ahead. Let’s explore three key trends shaping the future of expense management.

Ai And Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are becoming vital in expense management. These technologies help automate tasks. They can classify expenses, detect anomalies, and provide insights. This reduces manual effort and errors. Businesses save time and money. AI and ML also enhance decision-making by offering predictive analytics. This allows for better financial planning and management.

Mobile Accessibility

Mobile accessibility is crucial in today’s fast-paced world. Expense management software must be accessible on mobile devices. Employees can submit expenses from anywhere. They can take photos of receipts and upload them instantly. This boosts productivity and ensures timely submissions. Managers can also approve expenses on the go. This speeds up the approval process and improves workflow.

Blockchain Technology

Blockchain technology is gaining traction in expense management. It offers a secure and transparent way to record transactions. Blockchain can help prevent fraud by providing an immutable ledger. This ensures data integrity and trust. It also simplifies the audit process. Auditors can easily trace transactions, reducing the time and effort needed for reviews.

Credit: www.zoho.com

Frequently Asked Questions

What Is Expense Management Software?

Expense management software helps businesses track, manage, and report expenses. It simplifies the process of expense reporting and reimbursement.

How Does Expense Management Software Work?

Expense management software automates expense tracking and reporting. Users submit expenses, which are then reviewed and approved by managers.

Why Use Expense Management Software In The Uk?

Using expense management software in the UK ensures compliance with local tax laws. It also improves efficiency and reduces errors in expense reporting.

Which Expense Management Software Is Best For Small Businesses?

For small businesses, consider software that is affordable and easy to use. Look for features like receipt scanning and integration with accounting systems.

Conclusion

Choosing the best expense management software in the UK can simplify your finances. These tools help track spending, manage budgets, and save time. Each software has unique features to fit different needs. Evaluate your requirements and pick the right one.

With the right software, managing expenses becomes effortless. Make your financial management stress-free and efficient. Take control of your expenses today.