Insurance costs for a travel softball team can vary widely. Factors include team size, coverage needs, and provider choice.

Travel softball is exciting for players and families. But safety is crucial, and insurance is a key part of that. Covering medical expenses, accidents, and other unforeseen events ensures peace of mind. Understanding insurance costs and options helps in making informed decisions. Let’s explore the factors affecting travel softball team insurance costs and how to choose the best policy. For comprehensive travel insurance, consider EKTA’s plans, which offer extensive coverage and quick processing. Learn more at EKTA.

Introduction To Travel Softball Team Insurance

Organizing a travel softball team involves many responsibilities. One of the most critical aspects is ensuring the team is adequately insured. Travel Softball Team Insurance is a specialized type of insurance designed to cover the unique risks associated with traveling sports teams. This insurance is essential for protecting players, coaches, and the organization itself from unforeseen events.

What Is Travel Softball Team Insurance?

Travel Softball Team Insurance provides coverage for a variety of risks that a team might face during travel. These include injuries to players, damages to equipment, and liability for accidents or incidents involving the team.

- Player Injuries: Covers medical expenses and rehabilitation costs.

- Equipment Damage: Ensures that essential gear is repaired or replaced.

- Liability Coverage: Protects against legal claims arising from accidents or injuries.

This type of insurance is comprehensive and tailored to the specific needs of travel sports teams, ensuring peace of mind for everyone involved.

Why Is Insurance Necessary For Travel Softball Teams?

Insurance is crucial for travel softball teams for several reasons:

- Player Safety: Traveling increases the risk of injuries. Insurance covers medical costs.

- Financial Protection: Reduces the financial burden of unexpected expenses.

- Legal Compliance: Many leagues and tournaments require insurance.

Without proper insurance, teams could face significant financial losses and legal issues. Travel Softball Team Insurance ensures that the team is protected, allowing players to focus on the game without worrying about potential risks.

Credit: www.espspecialty.com

Key Features Of Travel Softball Team Insurance

Travel softball teams need reliable insurance to protect against unexpected events. Understanding the key features of travel softball team insurance can help you make informed decisions. Below, we explore the essential elements of this insurance coverage.

Coverage For Accidents And Injuries

Accidents and injuries are common in sports. Insurance for travel softball teams typically includes medical coverage for players. This can cover hospital stays, surgeries, and rehabilitation. Some policies also include dental injuries and emergency medical evacuation.

Liability Protection

Liability protection is crucial. This coverage shields the team from lawsuits. It includes protection against claims of negligence, property damage, and bodily harm. This is vital for both coaches and team managers.

Equipment Coverage

Equipment can be expensive. Travel softball team insurance often covers loss or damage to equipment. This includes bats, gloves, uniforms, and other gear. Coverage can also extend to theft or accidental damage during travel or games.

Travel And Trip Cancellation Insurance

Travel involves many uncertainties. Travel and trip cancellation insurance covers expenses if trips are canceled or delayed. It can include flight cancellations, hotel costs, and transportation. This ensures the team is financially protected against unforeseen travel issues.

For more information on travel insurance options, visit EKTA.

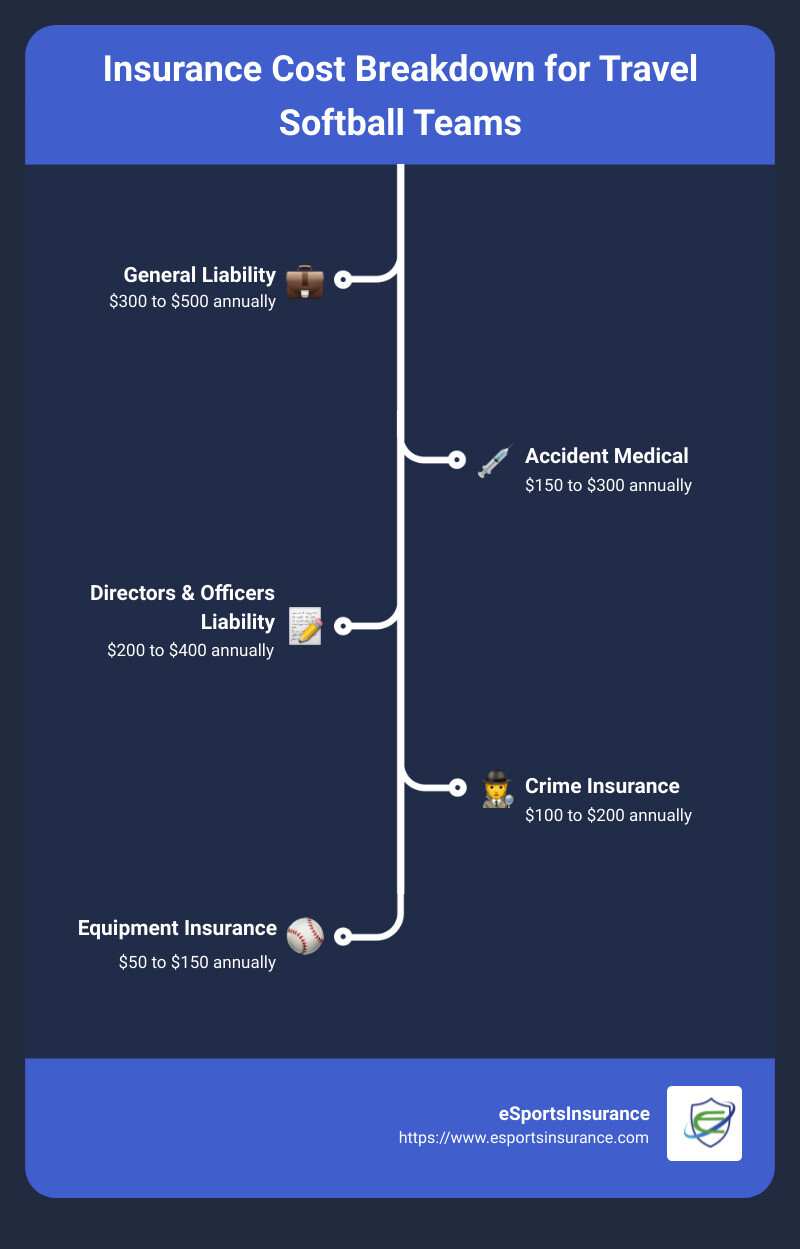

Cost Breakdown Of Travel Softball Team Insurance

Understanding the cost breakdown of insurance for a travel softball team is crucial. Teams must budget carefully to ensure all necessary coverages are included without overspending. Here’s a detailed look at the various aspects of travel softball team insurance costs.

Base Premiums

The base premiums are the primary cost of the insurance policy. These premiums cover the essential elements such as general liability and accident coverage. For a travel softball team, the base premiums can vary depending on the size of the team and the level of coverage needed. Typically, base premiums start at around $100 to $200 per team per year.

Additional Coverage Options

Beyond the base premiums, teams may opt for additional coverage options to enhance their protection. These options can include:

- Equipment Coverage: Protects against loss or damage to team gear.

- Travel Coverage: Covers incidents occurring during travel to and from games.

- Tournament Coverage: Adds protection for specific events or tournaments.

Each additional coverage option will increase the total insurance cost, but they provide valuable peace of mind.

Factors Influencing The Cost

Several factors can influence the cost of travel softball team insurance:

- Team Size: Larger teams may face higher premiums.

- Age Group: Younger teams might have different risk levels compared to older teams.

- Level of Play: Competitive teams participating in more tournaments might incur higher costs.

- Location: Insurance costs can vary based on the geographical area.

Discounts And Savings Opportunities

Teams can take advantage of various discounts and savings opportunities to reduce their insurance costs:

- Multi-Policy Discounts: Insuring multiple teams or combining different types of coverage can lead to savings.

- Safety Programs: Participating in certified safety programs can lower premiums.

- Early Payment Discounts: Paying premiums in advance may qualify teams for discounts.

By understanding these cost factors and seeking out discounts, travel softball teams can effectively manage their insurance expenses.

Credit: esportsinsurance.com

Pros And Cons Of Travel Softball Team Insurance

Travel softball team insurance is crucial for protecting players, coaches, and team management. Understanding its pros and cons can help you make an informed decision. Below, we discuss the main advantages and potential drawbacks.

Advantages Of Having Insurance

Having insurance for a travel softball team offers several benefits:

- Financial Protection: Covers medical expenses in case of player injuries.

- Liability Coverage: Protects coaches and team management from lawsuits.

- Equipment Coverage: Insures team equipment against loss or damage.

- Peace of Mind: Allows everyone to focus on the game without worrying about unforeseen incidents.

- Compliance: Meets league requirements for insurance coverage.

| Plan | Coverage | Cost | Deductible |

|---|---|---|---|

| Start Plan | $50,000 | $0.99/day | 25% |

| Gold Plan | $150,000 | $1.75/day | 0% |

| Max+ Plan | $500,000 | $5.9/day | 0% |

Potential Drawbacks And Considerations

While travel softball team insurance is beneficial, there are some considerations:

- Cost: Premiums can add up, especially for higher coverage plans.

- Deductibles: Some plans have deductibles that may be a financial burden.

- Policy Exclusions: Certain activities or situations might not be covered.

- Complexity: Understanding the terms and conditions can be challenging.

Evaluating these pros and cons helps in deciding the right insurance for your travel softball team.

Recommendations For Travel Softball Team Insurance

Ensuring your travel softball team has proper insurance is essential. This coverage protects against unexpected events and provides peace of mind. Here are some recommendations to help you choose the best insurance plan for your team.

Ideal Scenarios For Insurance Coverage

Insurance for a travel softball team is vital in several scenarios:

- Travel Accidents: Injuries or accidents during travel to games and tournaments.

- On-Field Injuries: Medical expenses from injuries during practices or games.

- Equipment Loss: Coverage for lost or damaged gear.

- Event Cancellations: Refunds or compensation for canceled games or tournaments.

Choosing The Right Insurance Plan

Choosing the best insurance plan involves evaluating your team’s specific needs. Consider these factors:

- Coverage Amount: Ensure the plan covers significant medical expenses and equipment costs.

- Plan Features: Look for comprehensive plans that include accident, medical, and liability coverage.

- Deductibles: Compare plans with varying deductibles to find one that fits your budget.

- Ease of Purchase: Opt for plans that are easy to buy and offer quick policy issuance.

| Plan Name | Coverage | Cost (per day) | Deductible |

|---|---|---|---|

| Start Plan | $50,000 | $0.99 | 25% |

| Gold Plan | $150,000 | $1.75 | 0% |

| Max+ Plan | $500,000 | $5.9 | 0% |

Tips For Reducing Insurance Costs

Here are some tips to help reduce insurance costs for your travel softball team:

- Group Discounts: Inquire about discounts for insuring multiple team members.

- Higher Deductibles: Opt for plans with higher deductibles to lower premium costs.

- Bundle Policies: Combine different types of insurance policies for better rates.

- Safety Measures: Implement safety protocols to reduce the likelihood of claims.

Choosing the right insurance plan for your travel softball team is crucial. Consider comprehensive coverage, evaluate costs, and look for discounts to ensure your team is well-protected and financially secure.

Credit: esportsinsurance.com

Frequently Asked Questions

What Is The Average Cost Of Travel Softball Team Insurance?

The average cost of travel softball team insurance varies. Typically, it ranges from $200 to $600 annually. Factors like team size and coverage type affect the price.

Why Is Insurance Important For A Travel Softball Team?

Insurance is crucial for covering potential injuries and liabilities. It protects the team, coaches, and players from unexpected expenses.

What Does Travel Softball Team Insurance Cover?

Travel softball team insurance usually covers player injuries, liability, and equipment damage. Specific coverage depends on the policy chosen.

How Can I Find Affordable Travel Softball Team Insurance?

To find affordable insurance, compare quotes from multiple providers. Check for discounts and choose coverage that fits your team’s needs.

Conclusion

Calculating the insurance cost for a travel softball team is essential. It ensures safety and financial security. By considering factors like team size and coverage needs, you can choose the best plan. For comprehensive travel insurance, consider EKTA. It offers extensive coverage, including COVID-19. Protect your team and travel with peace of mind. Remember, investing in the right insurance is key. Your team’s safety is always worth it.