Managing leads in the mortgage industry is crucial. It ensures efficiency and growth.

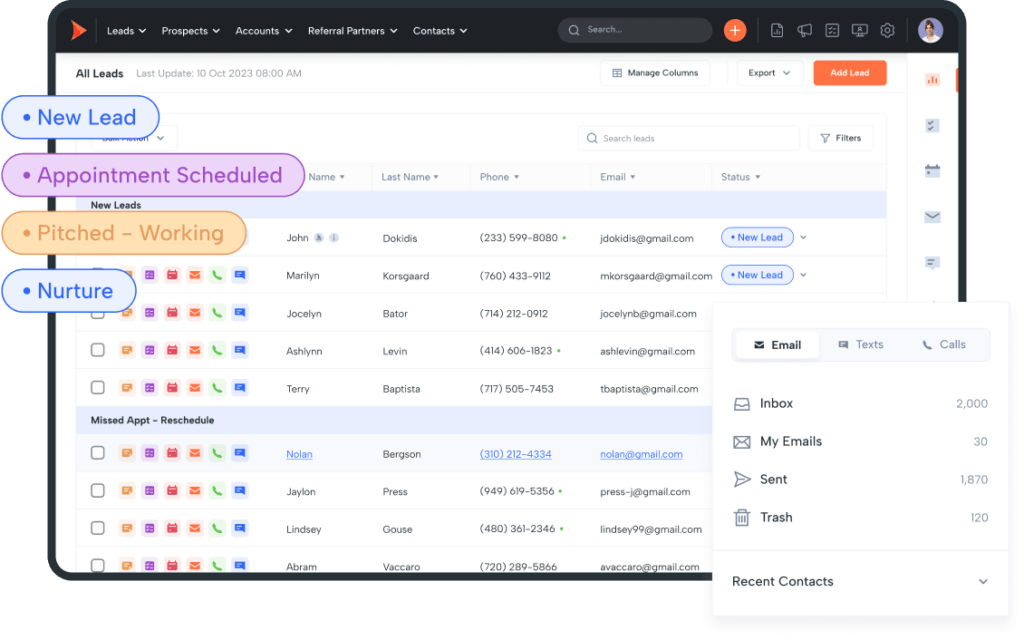

In today’s competitive mortgage market, handling leads effectively can make a big difference. Lead management software helps mortgage professionals track, manage, and convert leads into clients. It streamlines the entire process, saving time and reducing errors. This software centralizes all lead information, making it easy to access and update.

Mortgage brokers and loan officers can prioritize leads, follow up promptly, and close deals faster. This blog will explore the benefits of using lead management software for mortgages. You’ll learn how it can transform your business operations and improve customer relationships. Let’s dive into the details and see how this tool can enhance your mortgage business.

Introduction To Lead Management Software

In the fast-paced world of mortgage lending, managing leads efficiently is crucial. Lead Management Software helps mortgage brokers and lenders streamline their processes. It ensures they never miss an opportunity and improves customer satisfaction. This software is a key tool for growing mortgage businesses.

Importance In Mortgage Industry

The mortgage industry relies heavily on timely and precise communication. Lead Management Software helps by automating and organizing tasks. This includes tracking potential clients, setting reminders for follow-ups, and storing important client information. It saves time and reduces human error.

With this software, mortgage professionals can focus on building relationships. They can offer personalized services rather than being bogged down by administrative tasks. This leads to better customer experiences and higher conversion rates.

Evolution Of Lead Management

Lead management has come a long way. In the past, mortgage brokers used spreadsheets and paper files. This method was time-consuming and prone to mistakes. As the industry grew, the need for a more efficient system became apparent.

Early Lead Management Software offered basic features like contact storage and scheduling. Today, these systems are much more advanced. They use AI to analyze data and predict the best times to contact leads. They integrate with other tools, like email marketing and CRM systems, to provide a seamless experience.

The evolution of lead management has made it easier for mortgage professionals to stay organized. It has also improved their ability to convert leads into clients. This software is now an essential part of the mortgage industry.

Credit: www.clickpointsoftware.com

Key Features Of Mortgage Lead Management Software

Mortgage lead management software can transform your business operations. It streamlines processes, enhances customer interactions, and improves conversion rates. Understanding its key features can help you make an informed decision.

Automated Lead Capture

One of the essential features is automated lead capture. This functionality allows the software to collect leads from various sources without manual input. For instance, it can capture leads from:

- Website forms

- Email campaigns

- Social media platforms

- Third-party lead providers

Automated lead capture ensures no potential client is missed. It saves time and reduces human error. This feature allows your team to focus on engaging with qualified leads.

Customizable Workflows

Another significant feature is customizable workflows. These workflows can be tailored to fit your business needs. They help streamline and automate repetitive tasks. Some examples of customizable workflows include:

- Lead assignment rules

- Email follow-up sequences

- Task reminders

- Document management processes

Customizable workflows ensure every lead is nurtured properly. It enhances efficiency and improves the customer experience. Your team can focus on building relationships rather than administrative tasks.

Benefits For Mortgage Professionals

Lead management software offers many benefits for mortgage professionals. It helps streamline processes, improve client relations, and boost overall efficiency. Let’s explore some of these benefits in detail.

Enhanced Lead Tracking

Effective lead tracking is crucial for mortgage professionals. Lead management software provides tools to track leads from initial contact to closing. This ensures no lead falls through the cracks.

| Feature | Benefit |

|---|---|

| Automated Follow-Up Reminders | Never miss a follow-up call or email |

| Lead Scoring | Identify high-priority leads quickly |

| Customizable Pipelines | Track leads at different stages of the sales process |

With these features, mortgage professionals can manage their leads more effectively. This leads to better conversion rates and increased revenue.

Improved Client Communication

Clear and timely communication is key in the mortgage industry. Lead management software enhances client communication by offering various tools.

- Email Templates: Send personalized emails quickly.

- Automated Text Messages: Keep clients informed with updates.

- Client Portals: Provide clients with access to their information anytime.

These tools help build trust and improve client satisfaction. Clients appreciate timely updates and clear communication. This can lead to more referrals and repeat business.

Credit: setshape.com

Integrating With Existing Systems

Integrating lead management software with existing systems is crucial for mortgage businesses. This integration ensures seamless operations and enhances productivity. Let’s explore how CRM integration and data synchronization play a role in this process.

Crm Integration

Integrating lead management software with your CRM system is essential. It helps in managing customer relationships efficiently. The integration allows for the automatic transfer of lead information from the lead management software to the CRM. This ensures that all team members have access to the same data. It reduces the chances of errors and duplications.

The integration also helps in tracking the customer journey. You can monitor interactions with leads from the first contact to closing the deal. This provides valuable insights into customer behavior. It helps in tailoring your approach to meet their needs better.

Data Synchronization

Data synchronization is another vital aspect of integrating lead management software. It ensures that all systems have the most up-to-date information. This synchronization happens in real-time, keeping your data current.

With synchronized data, you can access accurate information at any time. This improves decision-making and enhances customer service. For instance, you can quickly retrieve a lead’s contact details or their status in the sales pipeline. It saves time and increases efficiency.

Here is a simple table that shows the benefits of data synchronization:

| Benefit | Description |

|---|---|

| Accuracy | Ensures all data is up-to-date |

| Efficiency | Saves time in retrieving information |

| Decision-Making | Provides accurate data for better decisions |

| Customer Service | Improves response time and service quality |

In summary, integrating lead management software with existing systems is crucial for mortgage businesses. CRM integration and data synchronization play a significant role in ensuring seamless operations and improving efficiency.

Boosting Loan Closures

Lead management software for mortgage lenders plays a key role in boosting loan closures. It enhances efficiency and ensures no potential client slips through the cracks. By automating tasks and organizing leads, the software helps lenders close more deals effectively.

Streamlined Processes

Lead management software streamlines all processes, from lead capture to loan closure. It simplifies data entry, reducing errors and saving time. Automated workflows ensure that each step in the process is completed promptly. This system provides a clear overview of each lead’s status, making it easy to prioritize tasks. As a result, lenders can focus on the most promising opportunities.

Faster Response Times

Quick response times are vital in the mortgage industry. Lead management software helps speed up responses to client inquiries. Automated alerts notify lenders when a new lead enters the system. This ensures that no lead waits too long for a response. Faster responses build trust and keep potential clients engaged. This increases the chances of closing the loan successfully.

Choosing The Right Software

Choosing the right lead management software for mortgage is essential. It can help streamline your processes and increase efficiency. But with so many options, how do you choose the best one? This section will guide you through key considerations and top providers.

Key Considerations

First, assess your business needs. Do you need a simple or complex system? Consider the size of your team and the volume of leads. A larger team may need more advanced features.

Next, think about the software’s ease of use. Is it user-friendly? Can your team learn it quickly? Time spent on training should be minimal.

Integration with existing tools is crucial. The software should work well with your current CRM and email systems. This ensures a smooth workflow.

Support and training are also important. Look for providers that offer good customer support. You may need help setting up or troubleshooting.

Lastly, consider the cost. Does the software fit your budget? Balance features with affordability.

Top Providers

Several top providers offer lead management software for mortgage businesses. One is Velocify. It is known for its robust features and ease of use.

Another provider is Jungo. It integrates well with Salesforce and offers many customization options.

Mortgage iQ CRM is another option. It provides comprehensive tools tailored for mortgage professionals.

Whiteboard Mortgage CRM is also worth considering. It offers user-friendly features and excellent customer support.

Lastly, BNTouch Mortgage CRM is a popular choice. It includes marketing automation and other valuable tools.

Choosing the right software can greatly impact your business. Consider your needs and explore these top providers to find the best fit.

Implementation Best Practices

Implementing lead management software for your mortgage business can transform your operations. To ensure a smooth transition, follow these best practices. They will help you maximize the benefits of the software while minimizing disruption.

Training Your Team

Proper training is essential for successful implementation. Your team needs to understand how to use the lead management software effectively. This will improve their efficiency and productivity.

- Conduct regular training sessions

- Provide user manuals and guides

- Offer support for troubleshooting

Ensure your training sessions cover all features of the software. This includes lead tracking, customer relationship management, and reporting tools. Encourage your team to ask questions and provide feedback.

Setting Up For Success

A well-thought-out setup can make a huge difference. Start by customizing the software to fit your business needs. This involves configuring user roles, permissions, and workflows.

| Setup Task | Description |

|---|---|

| Configure User Roles | Define who can access specific features |

| Set Permissions | Control what actions users can perform |

| Design Workflows | Streamline processes from lead capture to closing |

Regularly review and update your setup to ensure it remains aligned with your business goals. This practice helps in adapting to changes and maintaining efficiency.

Measuring Success

Effective lead management software can transform the mortgage process. But how do you measure its success? Understanding key metrics and fostering continuous improvement are crucial. Let’s dive into the details.

Key Metrics

Tracking the right metrics is essential for evaluating your lead management software’s performance. Here are some key metrics to consider:

- Lead Conversion Rate: The percentage of leads that become clients. A high conversion rate indicates effective lead nurturing.

- Response Time: The average time taken to respond to a lead. Faster response times often result in higher conversion rates.

- Cost Per Lead: The total cost of acquiring a lead. Lower costs suggest efficient marketing strategies.

- Lead Source Performance: Identifies which marketing channels bring the most valuable leads. Helps allocate resources effectively.

- Pipeline Stage Distribution: The number of leads at each stage of the sales pipeline. Reveals bottlenecks and areas for improvement.

Continuous Improvement

Success isn’t a one-time achievement. It requires ongoing efforts. Here are steps to ensure continuous improvement:

- Regularly Review Metrics: Schedule regular reviews of your key metrics. Identify trends and areas for improvement.

- Gather Feedback: Collect feedback from your team and clients. Use this information to refine your processes.

- Implement Training: Provide ongoing training for your team. Ensure they are well-versed in using the software and best practices.

- Adjust Strategies: Be flexible. Adjust your strategies based on the data you collect and feedback you receive.

- Leverage Automation: Use automation features in your lead management software. This can save time and reduce errors.

By focusing on key metrics and fostering a culture of continuous improvement, you can enhance your lead management process. This will ultimately lead to better results in your mortgage business.

Future Trends In Lead Management

The mortgage industry is evolving rapidly. Lead management software must adapt to these changes. Future trends in lead management for mortgage businesses are crucial to understand. This blog will explore key trends shaping the future of lead management.

Ai And Automation

AI and automation are transforming lead management. AI can analyze vast amounts of data quickly. It identifies potential leads and predicts customer behavior. Automation streamlines repetitive tasks, saving time and reducing errors. These technologies enhance efficiency and accuracy.

Imagine a system where AI scores leads based on their likelihood to convert. It uses historical data and machine learning algorithms. This allows sales teams to focus on high-potential prospects. Automation handles follow-up emails, scheduling, and data entry. This ensures no lead is overlooked and improves customer engagement.

Predictive Analytics

Predictive analytics is another significant trend. It helps businesses anticipate customer needs and behaviors. By analyzing past interactions and behaviors, predictive analytics forecasts future actions. This allows mortgage businesses to tailor their strategies accordingly.

For example, predictive analytics can identify patterns in customer data. It can suggest the best times to contact leads or which products to offer. This personalized approach increases the chances of conversion. It also enhances the customer experience, making interactions more relevant and timely.

Here is a simple table to illustrate the benefits of AI and predictive analytics:

| Feature | Benefit |

|---|---|

| AI Lead Scoring | Prioritizes high-potential leads |

| Automation | Saves time on repetitive tasks |

| Predictive Analytics | Forecasts customer behavior |

| Personalization | Enhances customer experience |

Incorporating these trends into lead management strategies will be essential. Mortgage businesses that adopt AI and predictive analytics will stay ahead of the competition.

Credit: www.boberdoo.com

Frequently Asked Questions

What Is Lead Management Software For Mortgage?

Lead management software for mortgage helps track and manage leads efficiently. It streamlines the process, improving conversion rates.

How Does Mortgage Lead Management Software Work?

Mortgage lead management software captures, organizes, and tracks leads. It automates follow-ups and nurtures leads through the sales funnel.

Why Use Lead Management Software In Mortgage Industry?

Using lead management software boosts efficiency, enhances customer experience, and increases conversion rates. It ensures no lead is overlooked.

What Are The Benefits Of Mortgage Lead Management Software?

Benefits include better lead organization, automated follow-ups, improved conversion rates, and enhanced customer satisfaction. It saves time and resources.

Conclusion

Adopting lead management software for mortgage businesses ensures efficiency and better client relations. This software streamlines the process, making it easier to track leads. It helps manage tasks, saving time and reducing errors. Businesses can focus more on client needs.

Investing in the right software boosts productivity and supports growth. Stay ahead in the competitive mortgage market by utilizing these tools. Embrace technology to enhance your service and client satisfaction. Lead management software is crucial for success in today’s mortgage industry.