Managing finances can be a daunting task for many businesses. Finding the right accounting software helps streamline this process.

In today’s digital age, the App Store offers a wide range of accounting software options. These apps help businesses of all sizes keep their finances in check. They come with various features to simplify tasks such as invoicing, expense tracking, and financial reporting.

With so many choices available, it can be challenging to decide which one is best for your needs. This blog post will guide you through the best accounting software available on the App Store. We will explore their features and benefits, helping you make an informed decision. Stay tuned to find the perfect accounting solution for your business!

Introduction To Accounting Software

In today’s digital age, managing finances can be a breeze. Accounting software helps businesses keep track of their financial health. It simplifies tasks like invoicing, payroll, and expense tracking. This software is essential for both small businesses and large enterprises. Understanding its benefits can make your work easier and more efficient.

Why Accounting Software Matters

Accounting software is crucial for several reasons. First, it saves time. Manual bookkeeping takes hours, but software can do it in minutes. Second, it reduces errors. Human mistakes can cost money. Software minimizes these risks. Third, it provides real-time data. You can make informed decisions quickly.

Moreover, it helps with compliance. Tax laws are complex. Good software ensures you meet all legal requirements. This is vital for avoiding penalties. Finally, it improves cash flow management. Knowing your financial position at any time is key to running a successful business.

Key Features To Look For

Choosing the right accounting software can be challenging. Here are some key features to consider:

- Ease of Use: The software should be user-friendly.

- Scalability: It should grow with your business.

- Automation: Look for features that automate repetitive tasks.

- Integration: Ensure it integrates with other tools you use.

- Reporting: Good software offers detailed financial reports.

- Security: Financial data must be secure and protected.

These features make managing finances simpler and more effective. Choose software that meets your specific needs.

Benefits Of Using Accounting Software

Accounting software from the App Store simplifies financial tasks. It helps track expenses, manage invoices, and generate reports quickly. Small businesses find it particularly useful for efficient bookkeeping.

Accounting software has become essential for businesses of all sizes. It streamlines financial tasks, reduces errors, and saves time. Using the right accounting software can offer numerous benefits. Let’s explore the key advantages.Efficiency And Accuracy

Accounting software automates many tedious tasks. This reduces the time spent on manual data entry. Automation also minimizes human errors. With built-in checks and balances, accuracy improves. Reports generated by software are more reliable. This gives a clear picture of your finances.Cost Savings

Manual accounting requires more manpower. This increases operational costs. Accounting software reduces the need for multiple staff. It also lowers the chances of costly errors. Accurate records help in better budgeting. This leads to smarter financial decisions. Over time, this saves money for the business.Scalability

As your business grows, so do your accounting needs. Manual processes can become overwhelming. Accounting software can easily scale with your business. It handles increased transactions without extra effort. This makes it easier to manage growth. The software adapts to your evolving needs, keeping you efficient. “`Top Accounting Software For Small Businesses

Small businesses need reliable accounting software to manage their finances. The right tool can save time, reduce errors, and help with tax preparation. Here are some top accounting software options for small businesses.

Quickbooks Online

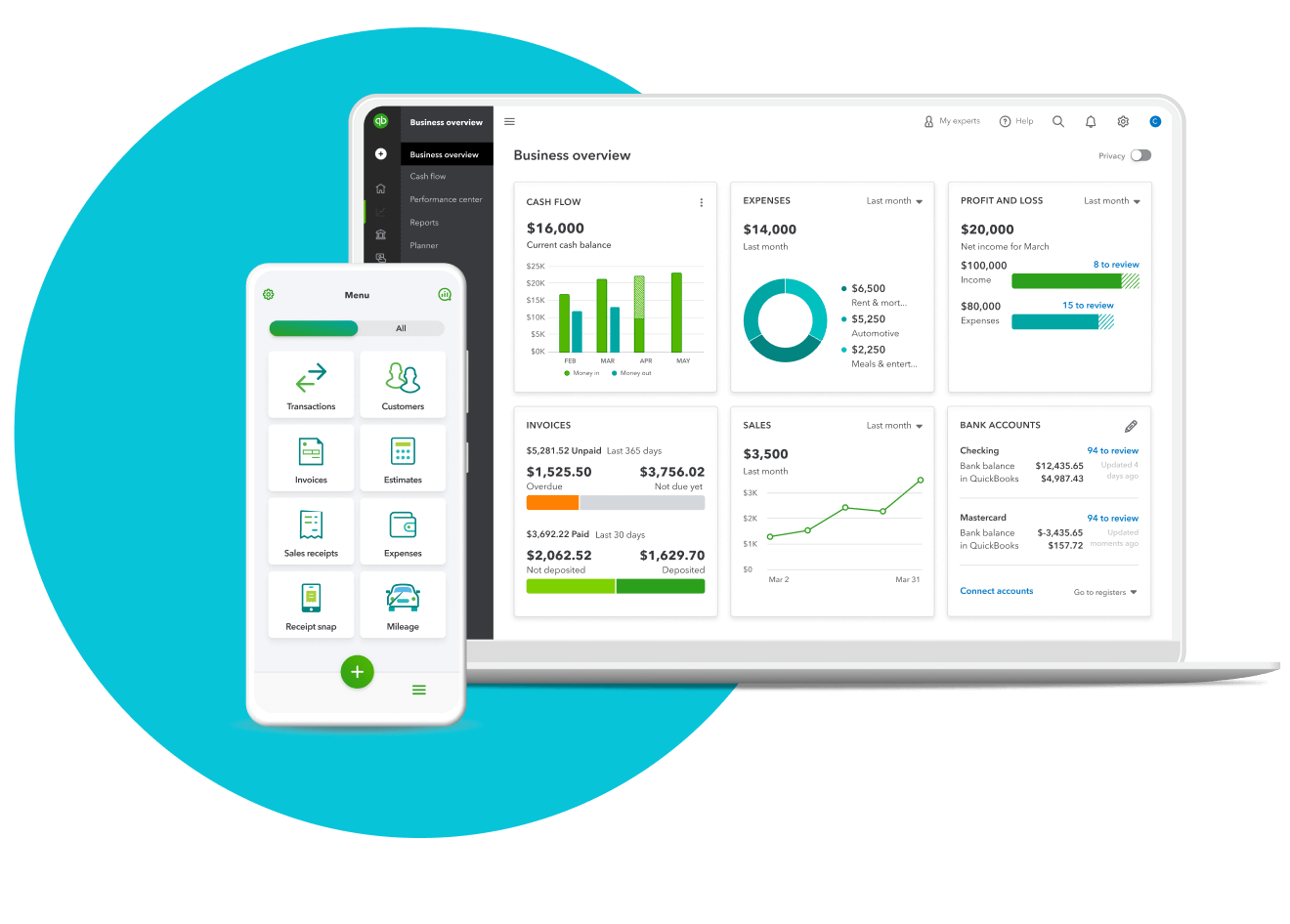

QuickBooks Online is popular among small business owners. It offers many features to streamline accounting tasks. Users can track income and expenses, send invoices, and manage cash flow. The software integrates with many other tools. This makes it easy to sync data across platforms.

QuickBooks Online also supports multiple users. This is helpful for small teams. The mobile app allows access to financial data on the go. With its user-friendly interface, QuickBooks Online is a solid choice for small businesses.

Freshbooks

FreshBooks is known for its simplicity and ease of use. It is ideal for small businesses and freelancers. Users can create professional invoices and track expenses. FreshBooks also offers time tracking features. This is useful for businesses that bill by the hour.

The software supports online payments. Clients can pay directly through the invoice, speeding up the payment process. FreshBooks integrates with various apps. This helps users manage their business more efficiently. Its intuitive design makes it easy for anyone to use.

Wave

Wave is a free accounting software option. It is perfect for small businesses on a budget. Despite being free, Wave offers many features. Users can track income and expenses, send invoices, and scan receipts. The software also supports multiple currencies.

Wave’s interface is clean and easy to navigate. The mobile app allows users to manage finances from anywhere. Wave also offers additional paid services. These include payroll and payment processing. For small businesses, Wave provides great value at no cost.

Credit: play.google.com

Best Accounting Software For Medium-sized Businesses

Choosing the right accounting software for a medium-sized business is crucial. It helps manage finances efficiently. The best tools offer robust features, scalability, and user-friendliness. Let’s explore some top accounting software options for medium-sized businesses.

Xero

Xero is a popular choice for medium-sized businesses. It offers a user-friendly interface. Businesses can track expenses, manage invoicing, and run payroll seamlessly. Xero also integrates with many third-party apps. This ensures smooth operations across various departments.

Sage 50cloud

Sage 50cloud combines the power of desktop software with cloud flexibility. It offers strong accounting features. Businesses can manage inventory, cash flow, and taxes efficiently. The cloud integration ensures data is accessible from anywhere. This makes it a reliable option for growing businesses.

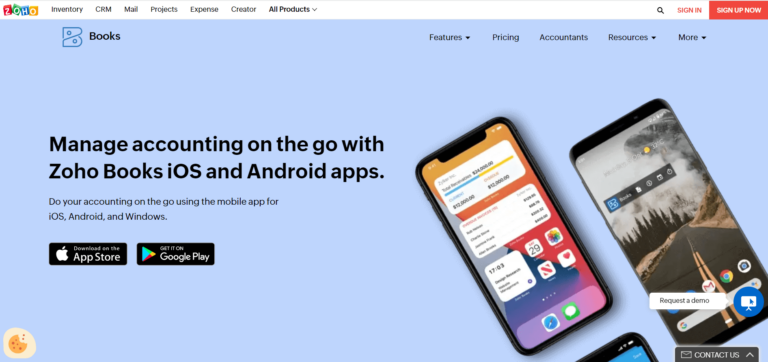

Zoho Books

Zoho Books is a comprehensive accounting solution. It is designed to meet the needs of medium-sized businesses. Users can handle invoicing, reconcile bank transactions, and generate financial reports. Zoho Books also offers automation features. These features help save time and reduce manual errors.

Top Picks For Large Enterprises

Choosing the right accounting software for large enterprises is crucial. These businesses need robust solutions. They require features that can handle complex financial operations. Here are our top picks for large enterprises.

Netsuite

NetSuite is a powerful accounting software. It offers a complete financial management solution. It is designed for large enterprises. NetSuite provides real-time financial data. This helps in making informed decisions. The software is cloud-based. This ensures data security and accessibility from anywhere. It also integrates with various other business applications. This makes it a versatile choice for large organizations.

Sap Business One

SAP Business One is another excellent choice. It is designed to manage your entire business. This includes accounting, financials, purchasing, inventory, and sales. It is suitable for large enterprises. SAP Business One offers real-time insights. It helps in streamlining business processes. The software is user-friendly. This makes it easier for employees to adapt. It also supports multiple currencies and languages. This is ideal for global operations.

Microsoft Dynamics 365

Microsoft Dynamics 365 offers a comprehensive accounting solution. It is designed for large enterprises. The software provides advanced financial management tools. These tools help in managing budgets, forecasting, and financial reporting. It integrates seamlessly with other Microsoft products. This includes Office 365 and Azure. The software is highly customizable. This allows businesses to tailor it to their specific needs. Microsoft Dynamics 365 also offers strong security features. This ensures that your financial data is protected.

Credit: www.tailorbrands.com

User-friendly Options For Non-accountants

For non-accountants, finding the right accounting software can be daunting. They need tools that are easy to use, intuitive, and efficient. Fortunately, many app store options cater to non-accountants. These apps simplify the accounting process and make managing finances a breeze.

Kashoo

Kashoo is a straightforward accounting app. Its interface is clean and simple. Users can quickly enter expenses and income. It offers basic but essential features. Kashoo is perfect for small business owners. You don’t need accounting knowledge to use it. It also provides excellent customer support. If you need help, they are just a call away.

Freeagent

FreeAgent is another user-friendly option. It caters to freelancers and small businesses. The app simplifies invoicing and expense tracking. Users can easily manage their finances. FreeAgent integrates with many banks. This feature saves time and reduces errors. Its dashboard is very intuitive. Even beginners can navigate it with ease.

Zipbooks

ZipBooks is a top choice for non-accountants. It offers a free version with essential features. Users can track income and expenses effortlessly. ZipBooks also provides useful insights. These insights help users understand their financial health. The app’s design is user-friendly. It makes accounting less intimidating for beginners. ZipBooks also has strong customer support. They are always ready to assist.

Mobile Accounting Software

In today’s fast-paced world, having mobile access to your accounting software is essential. Mobile accounting software allows you to manage your finances on the go. It offers the flexibility to work from anywhere, anytime. This means you can stay on top of your financial health even when you’re away from the office.

Benefits Of Mobile Access

Mobile access to accounting software brings several benefits:

- Convenience: You can check your accounts anytime, anywhere.

- Real-time Updates: Get instant updates on your financial status.

- Improved Accuracy: Reduce errors with real-time data entry.

- Increased Productivity: Save time by managing your accounts on the go.

These benefits help you make better financial decisions quickly.

Best Apps For On-the-go

Here are some top mobile accounting apps that offer great features:

| App Name | Key Features |

|---|---|

| QuickBooks | Invoicing, expense tracking, real-time data, bank sync |

| FreshBooks | Time tracking, expense management, detailed reports |

| Xero | Multi-currency, project management, payroll integration |

| Wave | Free for small businesses, invoicing, receipt scanning |

Each of these apps offers unique features suitable for different needs. Choose one that fits your business requirements best.

Security And Compliance

Security and compliance are crucial for accounting software. These features protect your financial data and ensure you meet legal requirements. This section delves into the key aspects of security and compliance in the best accounting software available in the App Store.

Data Protection

Protecting your financial data is vital. The best accounting software uses advanced encryption to secure your information. Encryption turns your data into unreadable code. Only authorized users can access it.

Two-factor authentication adds an extra layer of security. It requires a second form of verification, like a text message code. This makes unauthorized access much harder.

Regular software updates are also important. They fix security flaws and keep your data safe. Top accounting software providers offer frequent updates. Always install these updates promptly.

Regulatory Compliance

Meeting legal standards is a must. The best accounting software helps you stay compliant with various regulations. These include tax laws and financial reporting standards.

Built-in tax compliance features ensure you file taxes correctly. They calculate the right amounts and generate necessary forms. This reduces the risk of errors and penalties.

Financial reporting tools help you meet audit requirements. They generate reports that comply with standard accounting practices. This makes audits smoother and less stressful.

| Feature | Description |

|---|---|

| Encryption | Secures data by converting it into unreadable code |

| Two-Factor Authentication | Requires a second form of verification for access |

| Regular Updates | Fixes security flaws and enhances protection |

| Tax Compliance | Ensures correct tax filing and form generation |

| Financial Reporting | Generates audit-compliant reports |

Choosing The Right Software

Choosing the right accounting software can be challenging. With many options on the App Store, it’s important to pick one that meets your needs. Let’s explore the key points to consider.

Assessing Your Needs

Start by understanding what you need from the software. Do you need to track expenses? Create invoices? Manage payroll? Make a list of must-have features. This will help narrow down your choices.

Budget Considerations

Consider how much you are willing to spend. Some software has a one-time fee. Others require a monthly subscription. Compare the costs and benefits. Choose one that fits your budget without compromising on essential features.

Trial And Support Options

Check if the software offers a free trial. This lets you test it before committing. Also, look at the support options. Good customer support is vital. It can save you time and frustration. Make sure help is available when you need it.

Future Trends In Accounting Software

The accounting software landscape is evolving rapidly. New technologies are transforming how businesses manage their finances. Staying updated with these trends is crucial for making informed decisions. Let’s explore the future trends in accounting software.

Ai And Automation

Artificial Intelligence (AI) and automation are reshaping accounting processes. AI can handle repetitive tasks with precision. This includes data entry, invoice processing, and reconciliations. Automation reduces manual efforts and errors. It enhances efficiency and saves time.

AI-powered analytics provide deeper insights. Predictive analytics help in forecasting financial trends. AI-driven chatbots offer instant customer support. They answer queries and assist with transactions. These advancements streamline operations and improve accuracy.

Blockchain Integration

Blockchain technology is gaining traction in accounting. It ensures secure and transparent transactions. Blockchain creates a tamper-proof ledger. Every transaction is verified and recorded in real-time. This reduces the risk of fraud and errors.

Smart contracts automate and enforce agreements. They eliminate the need for intermediaries. This speeds up processes and reduces costs. Blockchain enhances trust and accountability in financial transactions.

Cloud-based Solutions

Cloud-based accounting software is becoming the norm. It offers flexibility and accessibility. Users can access data from anywhere, anytime. This is especially beneficial for remote and distributed teams.

Cloud solutions provide real-time updates. They facilitate collaboration among team members. Data is stored securely with regular backups. This ensures business continuity in case of data loss.

Subscription-based models make cloud software affordable. Businesses can scale their usage as needed. This reduces upfront costs and ensures budget-friendly solutions.

| Feature | Benefits |

|---|---|

| AI and Automation | Efficiency, Accuracy, Time-saving |

| Blockchain Integration | Security, Transparency, Reduced Fraud |

| Cloud-Based Solutions | Flexibility, Accessibility, Cost-effective |

These trends are shaping the future of accounting software. Embracing them can provide significant benefits for businesses.

Credit: developer.apple.com

Frequently Asked Questions

What Is The Best Accounting Software For Small Businesses?

The best accounting software for small businesses varies. Popular options include QuickBooks, Xero, and FreshBooks. They offer user-friendly interfaces, robust features, and affordable pricing.

Can I Use Accounting Software On My Mobile?

Yes, most accounting software offers mobile apps. You can manage your finances on the go. QuickBooks, Xero, and FreshBooks have highly-rated mobile apps.

How Secure Is Accounting Software?

Accounting software is highly secure. It uses encryption and other security measures. Always choose reputable software providers to ensure data safety.

Do I Need Accounting Knowledge To Use The Software?

No, most accounting software is designed for non-accountants. They offer tutorials and support. You can easily manage your finances without extensive accounting knowledge.

Conclusion

Choosing the best accounting software can simplify your financial tasks. It helps manage invoices, track expenses, and generate reports. Each app has unique features to fit different needs. Evaluate your requirements and budget. Test a few options if possible. This way, you find the right fit for your business.

Efficient accounting software saves time and reduces errors. Make an informed choice and enjoy smoother financial management.