Managing finances is crucial for any business. Effective billing software can make this task easier.

Are you looking for the best accounting billing software? This blog post will guide you through top options available today. Accounting billing software helps streamline invoicing, track payments, and manage expenses. With so many choices, finding the right one can be tough.

Whether you run a small business or a large corporation, the right software can save you time and reduce errors. In this post, we’ll explore features, ease of use, and pricing. This will help you make an informed decision. Let’s dive in and find the perfect solution for your accounting needs.

Introduction To Accounting Billing Software

In today’s digital age, managing finances efficiently is crucial for businesses. Accounting billing software plays a vital role in simplifying financial tasks. It automates billing, tracks expenses, and ensures accurate financial records.

Importance Of Billing Software

Billing software is essential for several reasons:

- It reduces manual errors.

- It saves time and effort.

- It ensures timely payments.

- It provides accurate financial records.

Businesses can focus more on growth and less on managing invoices. Accurate billing ensures customer satisfaction and trust. With automated systems, human error is minimized.

Benefits For Businesses

Using billing software offers numerous benefits:

- Efficiency: Speeds up the billing process.

- Accuracy: Reduces mistakes in invoices.

- Cost-saving: Cuts down administrative costs.

- Record-keeping: Keeps detailed transaction records.

- Integration: Works well with other financial tools.

Businesses can also enjoy better cash flow management. With timely invoicing, payments are received faster. This software often includes features like report generation and analytics. These help businesses make informed financial decisions.

| Feature | Benefit |

|---|---|

| Automation | Saves time |

| Accuracy | Reduces errors |

| Integration | Works with other tools |

| Analytics | Informs decisions |

Choosing the right accounting billing software can transform business operations. It not only simplifies tasks but also enhances overall efficiency.

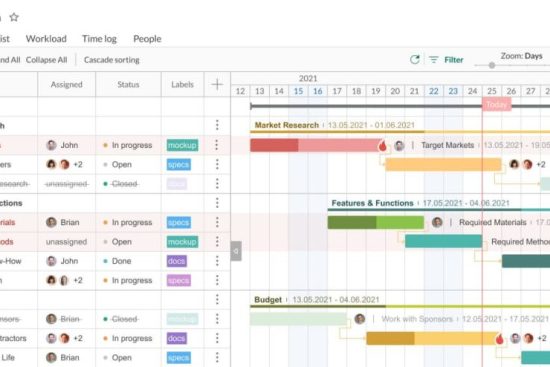

Credit: www.paymoapp.com

Key Features To Look For

Choosing the right accounting billing software can transform your business. It’s crucial to identify the key features that will streamline your financial operations. Here are the essential features you should prioritize.

Automated Invoicing

Automated invoicing is a must-have feature for any accounting software. It saves time and reduces errors. With automated invoicing, you can:

- Generate invoices quickly

- Set up recurring invoices

- Send reminders for overdue payments

Automated invoicing also enhances your cash flow management. It ensures timely payments and improves customer satisfaction.

Expense Tracking

Expense tracking helps you monitor and manage your business expenses. Effective expense tracking features include:

- Recording expenses in real-time

- Categorizing expenses for better analysis

- Attaching receipts and documents

Tracking expenses accurately helps in budgeting and financial planning. It also aids in tax preparation and compliance.

These features ensure you have a robust and efficient accounting system. Make sure your chosen software includes these capabilities.

Top Accounting Billing Software Options

Choosing the right accounting billing software can be a game-changer for businesses. It helps in streamlining billing processes, managing invoices, and maintaining accurate financial records. With numerous options available, it can be challenging to find the best fit for your needs. Let’s explore some of the top accounting billing software options to help you make an informed choice.

Popular Software Choices

Several accounting billing software solutions stand out in the market. QuickBooks is a popular choice due to its user-friendly interface. FreshBooks is known for its excellent customer service. Xero offers powerful features for small to medium-sized businesses. Zoho Books provides a comprehensive suite of tools for managing finances. Each of these options has unique strengths that cater to different business needs.

Comparison Of Features

QuickBooks offers robust invoicing, expense tracking, and payroll management. FreshBooks excels in time tracking and project management. Xero provides advanced reporting and inventory management. Zoho Books integrates well with other Zoho products and offers multi-currency support. Comparing these features can help you decide which software aligns best with your business requirements.

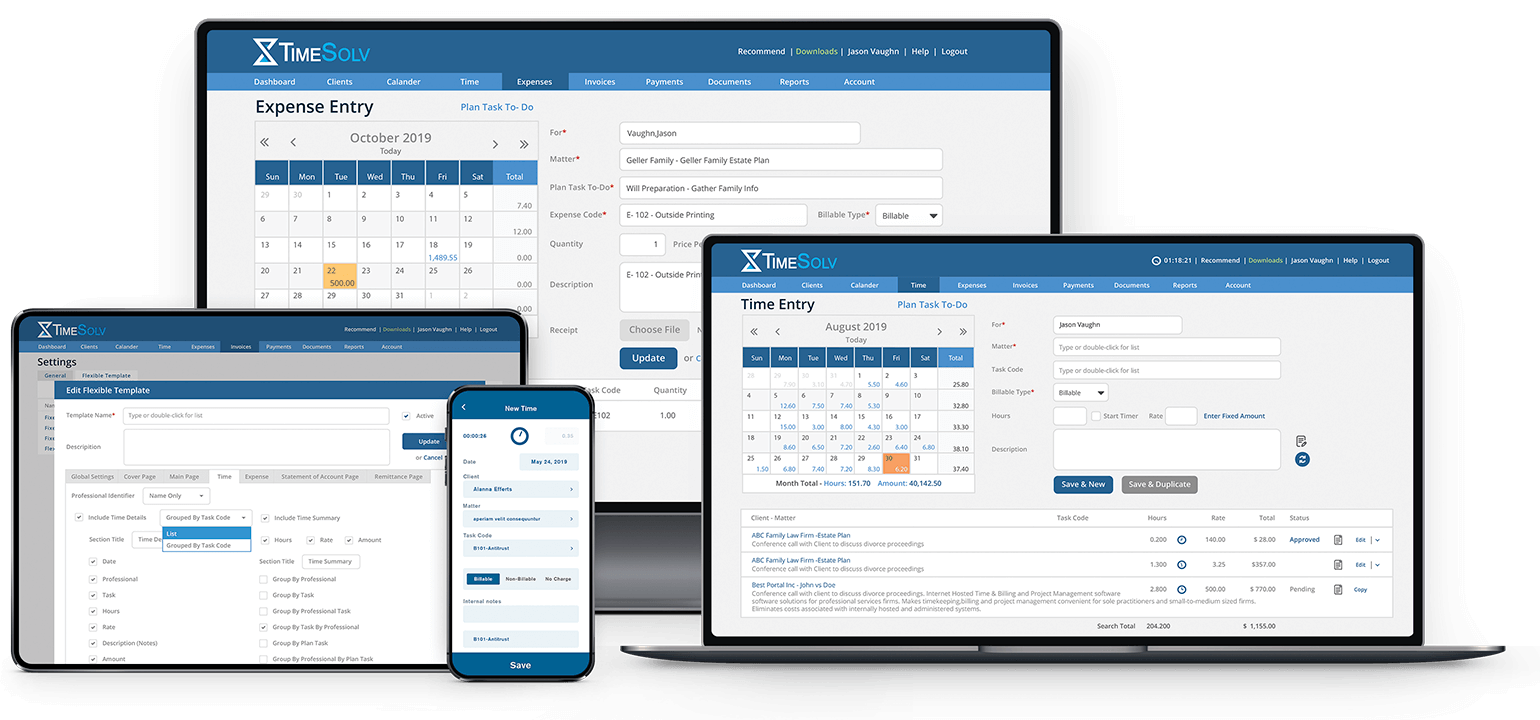

Credit: www.timesolv.com

Choosing The Right Software

Finding the best accounting billing software for your business is essential. It ensures efficiency and accuracy. But how do you choose the right one? Consider your unique business needs and your budget.

Assessing Business Needs

First, understand what your business requires. A small business may need basic billing features. A larger company might need advanced tools. Identify key features that will help your business grow. These features could include:

- Invoicing

- Expense tracking

- Payroll management

- Tax calculation

Make a list of your must-have features. This will help you narrow down your options. Also, consider the software’s user interface. It should be easy to navigate. Your team should feel comfortable using it. This will save time and reduce errors.

Budget Considerations

Next, determine your budget. Accounting software comes in various price ranges. Some are free, while others require a subscription. Compare the cost with the features offered. Sometimes, a higher price means more features. But, you may not need all of them.

| Type | Cost | Features |

|---|---|---|

| Basic | Free – $20/month | Invoicing, Expense Tracking |

| Standard | $20 – $50/month | Payroll, Tax Calculation |

| Premium | $50+/month | Advanced Reporting, Multi-user Access |

Invest in software that fits your budget and meets your needs. Look for discounts or free trials. This can help you make an informed decision.

Implementation And Setup

Implementing and setting up the best accounting billing software can seem daunting. But with the right steps, it becomes manageable. This guide will walk you through the key stages of the process. It covers the initial setup, data migration, and more. Follow these steps to ensure a smooth setup.

Initial Setup Steps

Starting with the initial setup is crucial. Here are the steps:

- Download and Install: Begin by downloading the software from the official website. Follow the installation instructions.

- Create an Account: Sign up for an account. Use a strong password to protect your data.

- Configure Settings: Set up basic settings. Include company name, logo, and contact details.

- Set Up Users: Add users and assign roles. Ensure each user has the appropriate permissions.

Data Migration

Data migration is a critical step. Follow these steps to move your data:

| Step | Description |

|---|---|

| 1. Export Data | Export your data from the old system. Save it in a compatible format like CSV. |

| 2. Clean Data | Review the exported data. Remove duplicates and correct errors. |

| 3. Import Data | Use the software’s import function. Upload the cleaned data files. |

| 4. Verify Data | Check the imported data. Ensure accuracy and completeness. |

By following these steps, you can ensure a successful setup. This makes the best accounting billing software ready for use in your business.

Maximizing Software Potential

Accounting billing software is powerful. Its full potential can transform your business operations. Understanding how to maximize its features is key. Let’s explore some aspects to get the most out of your accounting software.

Customizable Features

Each business has unique needs. Customizable features allow tailoring the software to fit these needs. You can set up personalized invoice templates, payment terms, and report formats.

This flexibility ensures that the software works the way you do. For example, you can create specific tax rules or discount policies. This ensures that every invoice meets your business requirements.

- Personalized invoice templates

- Custom payment terms

- Flexible report formats

Integration With Other Tools

Integration boosts efficiency. Your accounting software should work well with other tools. This includes CRM systems, payment gateways, and inventory management software.

For instance, integrating with a CRM system keeps customer data in sync. This means less manual data entry and fewer errors. Similarly, linking with payment gateways speeds up the payment process.

| Tool | Benefit |

|---|---|

| CRM System | Sync customer data |

| Payment Gateway | Faster payments |

| Inventory Management | Track stock levels |

Integration ensures that all your systems work together seamlessly. This improves overall productivity and reduces errors.

Common Challenges And Solutions

Managing finances through accounting billing software can present common challenges. These challenges often disrupt smooth operations and affect efficiency. Here, we explore technical issues and user training difficulties. Understanding these challenges and their solutions helps businesses operate more effectively.

Technical Issues

Technical issues can slow down your accounting software. These problems include software crashes, slow performance, and compatibility issues. Crashes can lead to data loss. Slow performance frustrates users. Compatibility issues arise with other software or hardware. Regular updates help solve these problems. Updates fix bugs and improve performance. Ensuring your software and hardware are compatible also helps. Regularly check for updates and install them promptly.

User Training

Many users find accounting software complex. Without proper training, they struggle to use it effectively. This leads to errors and inefficiencies. Providing thorough training is essential. Training should be simple and easy to follow. Use clear instructions and practical examples. Offer ongoing support to address user queries. Regular training sessions keep users up-to-date with new features. This ensures they use the software to its full potential.

Future Trends In Accounting Software

The world of accounting software is evolving rapidly. Businesses need to stay updated to maintain a competitive edge. Below are some exciting future trends in accounting software that are set to transform the industry.

Ai And Automation

Artificial Intelligence (AI) and automation are revolutionizing accounting. These technologies help in reducing manual tasks and errors. With AI, the software can learn and adapt, offering better insights and predictions. Automation ensures that repetitive tasks are handled efficiently.

Key benefits include:

- Faster data processing

- Improved accuracy

- Cost savings

Businesses can focus more on strategic tasks. This shift enhances productivity and decision-making.

Cloud-based Solutions

Cloud-based accounting software is becoming the norm. It offers flexibility and accessibility. Users can access data from anywhere, at any time. This is essential for remote work and distributed teams.

Advantages of cloud-based solutions:

| Feature | Benefit |

|---|---|

| Remote Access | Work from anywhere |

| Real-Time Updates | Always have the latest data |

| Scalability | Grow with your business |

This trend ensures that businesses stay agile and responsive. It also helps in reducing IT costs and infrastructure maintenance.

Credit: www.pipedrive.com

Frequently Asked Questions

What Is The Best Accounting Billing Software?

The best accounting billing software varies based on needs. Popular options include QuickBooks, FreshBooks, and Xero. They offer comprehensive features for invoicing and expense tracking.

How Does Billing Software Help Businesses?

Billing software automates invoicing, tracks expenses, and manages client accounts. It saves time and reduces errors. It also improves cash flow management.

Can Billing Software Integrate With Other Tools?

Yes, most billing software integrates with tools like CRM, payroll, and banking. This ensures seamless data flow and improved efficiency.

Is Accounting Billing Software Secure?

Yes, reputable accounting billing software uses encryption and other security measures. This ensures data protection and confidentiality.

Conclusion

Choosing the right accounting billing software can simplify your business operations. It helps you save time, reduce errors, and improve cash flow. Explore different options and find the one that fits your needs. Remember, the best software should make your work easier and more efficient.

Take the time to test and compare features. Your business deserves the best tools to thrive. Happy accounting!