Choosing the right accounting software can be a game changer. It simplifies managing finances for businesses of all sizes.

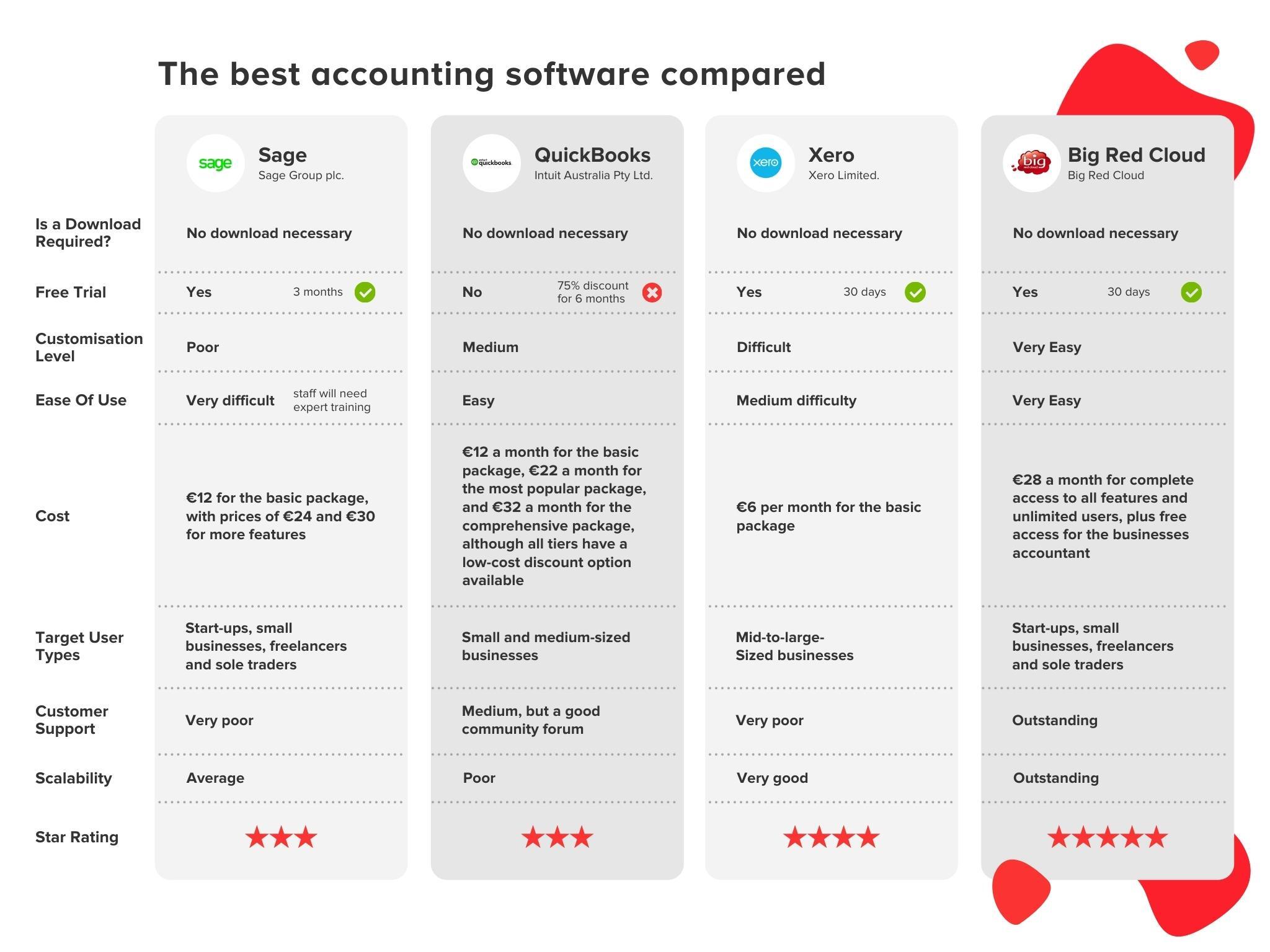

With so many options available, finding the best fit for your business can be challenging. This comparison aims to help you navigate through popular accounting software choices. Each has unique features tailored to different needs. Whether you are a freelancer, small business owner, or managing a large enterprise, understanding the differences can save you time and money.

This guide will explore various software options, highlighting key features and benefits. By the end, you will have a clearer picture of which accounting software aligns with your business needs, making your decision easier and more informed. Let’s dive in and find the perfect match for your accounting requirements.

Credit: howtostartanllc.com

Introduction To Accounting Software

Accounting software plays a crucial role for businesses of all sizes. It helps manage financial transactions and ensures accuracy. In today’s digital age, using accounting software is essential. It streamlines processes, saves time, and reduces errors. But with so many options available, choosing the best one can be challenging. This section will introduce you to accounting software and its significance.

Importance Of Accounting Software

Accounting software is important for several reasons. It automates repetitive tasks, reducing manual work. This increases efficiency and productivity. Businesses can track expenses, revenue, and profits in real time. This helps in making informed financial decisions. Accounting software ensures compliance with tax regulations. It generates accurate financial reports, which are crucial for audits. It also enhances data security, protecting sensitive financial information.

Trends In 2024

The accounting software landscape is evolving rapidly. In 2024, we expect several trends to shape the industry. Cloud-based solutions are becoming more popular. They offer flexibility and remote access. AI and machine learning are integrating into accounting software. This enhances automation and predictive analytics. Mobile compatibility is another key trend. Users demand access to financial data on the go. Blockchain technology is also making its way into accounting. It offers enhanced security and transparency. These trends are transforming how businesses handle their finances.

Key Features To Look For

Choosing the best accounting software can be tough. The right features make the job easier. This section covers the key features you should consider. These include a user-friendly interface, automation capabilities, and integration options.

User-friendly Interface

A user-friendly interface is crucial. It ensures that even beginners can use the software. Look for a clear and simple layout. Menus should be easy to navigate. Icons should be intuitive. A dashboard that provides an overview of your finances is helpful. This makes it easier to manage accounts.

A good interface saves time and reduces errors. You can find what you need quickly. It helps you focus on accounting tasks, not the software itself. If the software has a steep learning curve, it may not be the best choice.

Automation Capabilities

Automation capabilities are essential. They reduce manual work and increase accuracy. Look for features like:

- Automatic invoicing: Generates and sends invoices without manual input.

- Expense tracking: Automatically categorizes and tracks expenses.

- Bank reconciliation: Matches transactions with bank statements.

- Recurring payments: Schedules regular payments automatically.

These features save time and ensure consistency. You can focus on more important tasks, knowing that routine work is handled.

Integration Options

Integration options are vital for seamless workflow. The software should integrate with other tools you use. These might include:

- CRM systems: Manage customer relationships and accounting in one place.

- Payroll services: Sync payroll data with your accounting software.

- Payment gateways: Accept and track payments easily.

- Project management tools: Track project expenses and budgets.

Good integration options increase efficiency. They reduce the need to switch between different tools. This ensures all your data is connected and up-to-date.

Top Accounting Software For Small Businesses

Choosing the right accounting software is crucial for small businesses. The right tool can save time, reduce errors, and help manage finances efficiently. Here are three top accounting software options for small businesses:

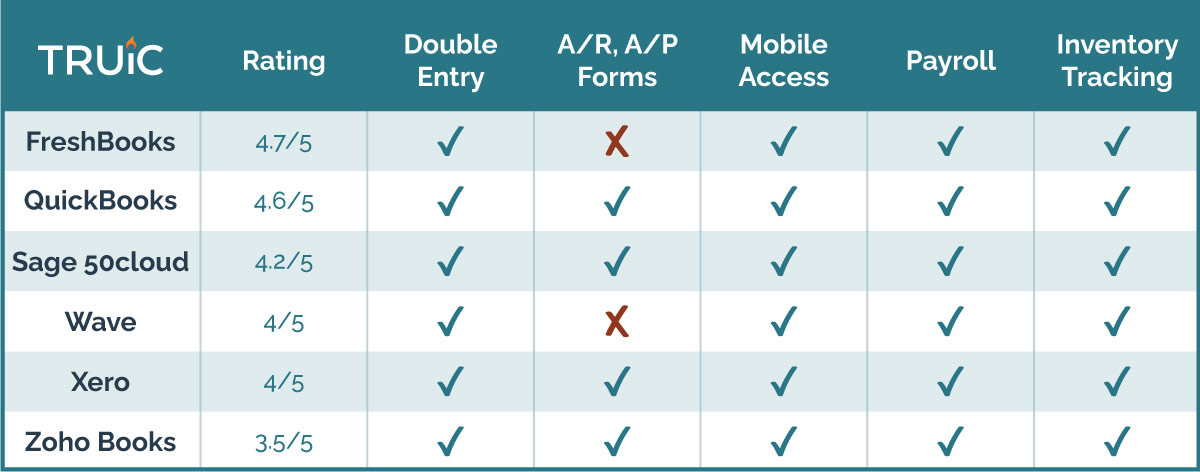

Quickbooks Online

QuickBooks Online is a popular choice among small businesses. It offers a variety of features that simplify accounting tasks. Key features include:

- Invoicing

- Expense tracking

- Bank reconciliation

- Financial reporting

QuickBooks Online integrates with many other business tools. It is also accessible from any device with an internet connection.

Freshbooks

FreshBooks is known for its user-friendly interface. It is ideal for small business owners who are not accountants. Some of its standout features are:

- Time tracking

- Client management

- Project management

- Automated invoicing

FreshBooks also offers excellent customer support. This makes it easier for users to get help when needed.

Wave

Wave is a free accounting software. It is perfect for small businesses with tight budgets. Wave offers essential features such as:

- Income and expense tracking

- Bank reconciliation

- Receipt scanning

- Invoicing

Despite being free, Wave provides reliable and secure accounting solutions. It is a great option for startups and freelancers.

| Feature | QuickBooks Online | FreshBooks | Wave |

|---|---|---|---|

| Price | From $25/month | From $15/month | Free |

| Invoicing | Yes | Yes | Yes |

| Expense Tracking | Yes | Yes | Yes |

| Bank Reconciliation | Yes | Yes | Yes |

| Customer Support | Good | Excellent | Limited |

Best Options For Large Enterprises

Choosing the right accounting software for large enterprises is crucial. It must handle complex financial data, ensure compliance, and integrate with other systems. Here, we compare three top options: NetSuite, Sage Intacct, and Microsoft Dynamics 365.

Netsuite

NetSuite is a powerful tool for large enterprises. It offers a comprehensive suite of applications. These include financial management, CRM, and e-commerce.

- Scalability: Grows with your business.

- Customizable: Tailor it to fit your needs.

- Global compliance: Adheres to international standards.

NetSuite’s cloud-based system ensures accessibility from anywhere. It also integrates with many other business tools, enhancing overall efficiency.

Sage Intacct

Sage Intacct is ideal for large organizations. It focuses on financial management and accounting. It provides real-time financial and operational insights.

- Automation: Reduces manual tasks.

- Multi-entity support: Manages multiple companies.

- Robust reporting: Offers detailed financial reports.

Sage Intacct is known for its strong audit trails. This ensures accurate and transparent financial records.

Microsoft Dynamics 365

Microsoft Dynamics 365 is a comprehensive business solution. It combines ERP and CRM capabilities. This makes it suitable for large enterprises.

- Integration: Works well with other Microsoft products.

- AI capabilities: Provides predictive insights.

- Flexibility: Adapts to various business needs.

Dynamics 365 offers advanced security features. This ensures your data is protected at all times.

| Feature | NetSuite | Sage Intacct | Microsoft Dynamics 365 |

|---|---|---|---|

| Scalability | High | Medium | High |

| Customization | Extensive | Moderate | Extensive |

| Integration | Wide range | Good | Excellent |

| Reporting | Advanced | Robust | Comprehensive |

| Security | Strong | Strong | Advanced |

These software options offer robust features for large enterprises. Each has unique strengths that cater to different business needs.

Specialized Software For Freelancers

Freelancers need accounting software tailored to their unique needs. They handle everything from invoicing to tax preparation. Specialized software can save time, reduce stress, and ensure accuracy.

Zoho Books

Zoho Books is a top choice for freelancers. It offers a user-friendly interface. You can manage invoices, track expenses, and handle taxes. Plus, it integrates with many third-party apps. This makes your workflow smoother.

- Invoicing: Create, send, and track invoices.

- Expenses: Record and monitor expenses.

- Tax Compliance: Automate tax calculations.

Xero

Xero is another excellent tool for freelancers. It is known for its robust features. You can reconcile bank transactions, create invoices, and keep track of spending. Xero also provides real-time financial insights.

- Bank Reconciliation: Reconcile transactions with ease.

- Invoicing: Send professional invoices.

- Financial Insights: Get real-time financial data.

Kashoo

Kashoo offers simplicity and functionality. It is perfect for freelancers needing straightforward accounting. You can manage income, expenses, and tax filings. Kashoo also provides excellent customer support.

- Income Tracking: Monitor all income sources.

- Expense Management: Keep a record of expenses.

- Tax Filings: Simplify your tax preparation.

Comparing Pricing And Plans

Choosing the best accounting software can be a daunting task. Different pricing models and plans can make this decision even harder. It’s important to understand the differences to pick the best option for your business needs.

Subscription Models

Many accounting software solutions use subscription models. These models charge a monthly or yearly fee. This recurring cost allows access to the software and regular updates. Subscription plans often come in tiers, offering various features. Basic plans may include invoicing and expense tracking. Higher-tier plans might offer advanced features like payroll and multi-user access.

One-time Purchases

Some accounting software providers offer one-time purchase options. This means you pay a single fee to own the software. These plans often appeal to businesses that prefer not to have ongoing costs. However, updates or additional features may require extra fees. One-time purchases can be cost-effective in the long run.

Free Vs. Paid Versions

Many accounting software providers offer free versions of their products. Free versions usually come with limited features. They can be great for small businesses or startups with simple needs. Paid versions offer more advanced features and better support. Investing in a paid plan can save time and increase efficiency. Consider your business size and needs when choosing between free and paid versions.

Customer Support And Resources

Choosing the best accounting software can be challenging. Customer support and resources play a significant role in the decision. The level of support and resources available can impact your experience. Let’s explore these aspects.

24/7 Support

24/7 support ensures you get help whenever needed. It’s especially important for businesses operating outside standard hours. Some software providers offer round-the-clock support. This includes phone, email, and live chat options. You can resolve issues quickly. This minimizes downtime and keeps your business running smoothly.

Online Resources

Online resources are valuable for self-guided learning. They often include tutorials, FAQs, and user guides. These resources help you understand the software better. They can save you time by providing quick answers to common questions. Some providers also offer video tutorials. These can be easier to follow than written instructions.

Community Forums

Community forums are another key resource. They allow users to share experiences and solutions. You can ask questions and get advice from other users. This peer support can be very helpful. Forums often have threads on various topics. These can be a treasure trove of useful information.

Credit: financial-cents.com

Security And Compliance

Choosing the right accounting software involves more than just features and pricing. Security and compliance are crucial aspects to consider. They protect your financial data and ensure you adhere to legal standards. Here, we will explore three key areas: Data Encryption, Compliance Standards, and User Permissions.

Data Encryption

Data encryption is essential for safeguarding sensitive financial information. The best accounting software uses advanced encryption techniques to protect your data from unauthorized access. This means that even if hackers intercept your data, they cannot read it.

Look for software with 256-bit SSL encryption, the same level used by banks. This ensures your data remains secure during transmission. Additionally, ensure the software encrypts data at rest. This provides an extra layer of protection when the data is stored on servers.

Compliance Standards

Compliance with industry standards is non-negotiable. It ensures your business adheres to legal and regulatory requirements. The best accounting software complies with GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards). These standards are essential for accurate financial reporting.

Many accounting software options also comply with GDPR (General Data Protection Regulation). This regulation protects the privacy and personal data of EU citizens. Always check the compliance certifications of the software to avoid legal issues.

User Permissions

Managing who has access to your financial data is crucial. The best accounting software offers detailed user permissions settings. This allows you to control who can view, edit, or delete financial information. You can assign roles based on job functions, ensuring employees only access the data they need.

For example, you might allow your accountant full access but restrict other employees to view-only permissions. This reduces the risk of errors and fraud, protecting your business from internal threats.

Conclusion And Recommendations

The best accounting software can streamline your financial tasks. We’ve reviewed the top options. Here’s a summary of our findings and recommendations.

Summary Of Top Picks

QuickBooks Online stands out for its user-friendly interface. It offers robust features for small to medium businesses. FreshBooks is ideal for freelancers. It excels in invoicing and expense tracking. Xero is great for larger businesses. It integrates well with other tools and provides strong reporting capabilities. Wave is the best free option. It’s perfect for very small businesses or startups. Zoho Books offers good value. It includes advanced automation features and integrates with other Zoho apps.

Choosing The Right Software

Consider your business size and needs. Small businesses benefit from user-friendly software. Look for ease of use and essential features. Medium to large businesses need advanced tools. Prioritize software with strong reporting and integration capabilities. Freelancers should focus on invoicing and expense tracking features. Budget-conscious users can opt for free or low-cost options. Always check for customer support quality. Good support can save time and reduce frustration. Ensure the software scales with your business growth. Flexibility is key for long-term use.

Credit: www.fisheraccountants.com

Frequently Asked Questions

What Is The Best Accounting Software For Small Businesses?

The best accounting software for small businesses varies. Popular options include QuickBooks, Xero, and FreshBooks. Each has unique features. Evaluate your business needs to choose the best fit.

How Does Accounting Software Save Time?

Accounting software automates tasks like invoicing, expense tracking, and reporting. This reduces manual data entry. It saves time and minimizes errors.

Can I Integrate Accounting Software With Other Tools?

Yes, most accounting software integrates with tools like CRM, payroll, and payment gateways. This streamlines business processes and enhances efficiency.

Is Accounting Software Secure?

Yes, reputable accounting software uses encryption and secure servers. It protects your financial data. Always choose software with strong security features.

Conclusion

Choosing the right accounting software can simplify your business operations. Each option offers unique features tailored to different needs. Evaluate your requirements carefully before making a decision. Whether you need basic bookkeeping or advanced financial analysis, there’s a solution for you.

Investing time in comparing options will save you headaches later. Remember, the best software fits your business size and goals. Make an informed choice to streamline your financial tasks and boost productivity. Thank you for reading our comparison guide. Happy accounting!